10-Year US Treasury Yield ‘Fair Value’ Estimate: 14 November 2024

The market premium for the US 10-year Treasury yield rose in October relative to a “fair value” estimate calculated by CapitalSpectator…The current market premium over the average fair value via the average of three models rose to 65 basis points, the highest since July…In …

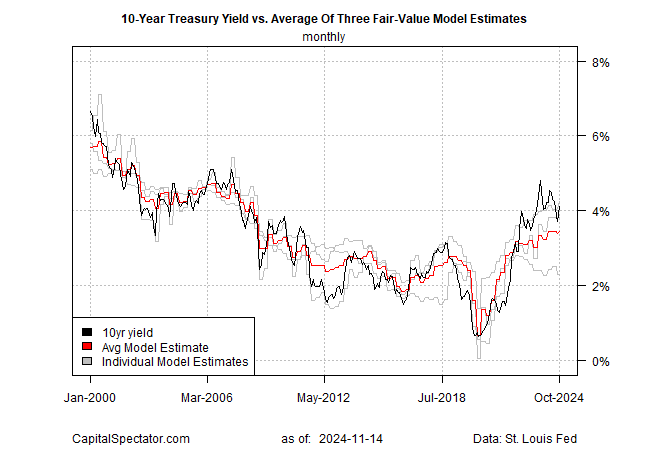

The market premium for the US 10-year Treasury yield rose in October relative to a “fair value” estimate calculated by CapitalSpectator.com. The increase marks the first time since April that the premium increased.

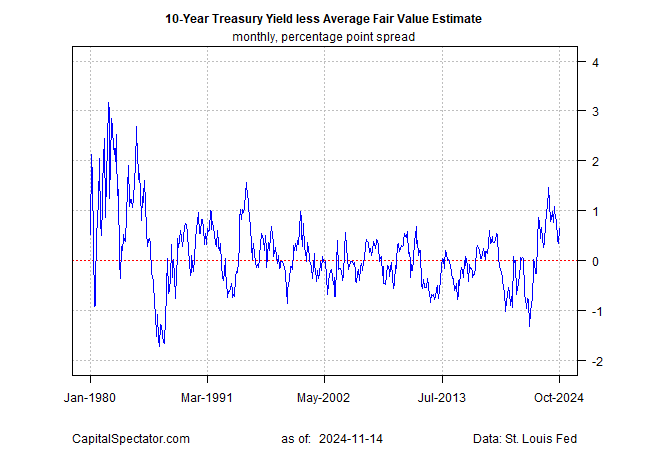

The current market premium over the average fair value via the average of three models rose to 65 basis points, the highest since July. It’s unclear if the reversal of what had been a sliding spread is a sign that the recent normalization of the premium has ended.

In recent years, following the Federal Reserve’s sharp shift to a hawkish monetary policy, the 10-year market premium shot higher and remained elevated, although not unprecedented. In 2024 the high premium started to fade and return to a normal range, i.e., a range that’s prevailed for most of the time in recent decades. The question is whether October results mark a break in the recent normalization process.

A key factor that may determine how the market premium unfolds in the months ahead is the change in the political calculus following Donald Trump’s election victory and Republican control of both chambers of Congress. The president-elect on the campaign trail outlined plans to raise import tariffs, deport millions of immigrants and implement a wide range of de-regulation measures for American companies – a policy shift that’s expected to strengthen inflationary pressures.

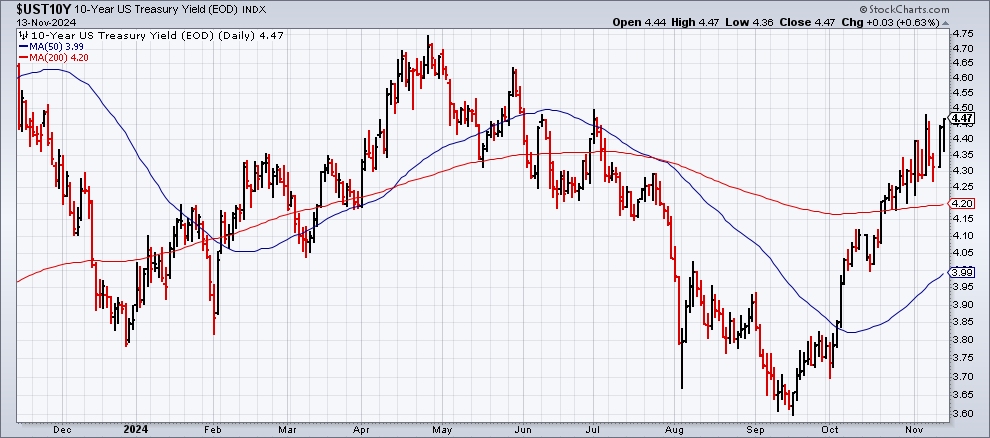

The recent rise in the 10-year yield suggests that bond market is pricing in higher inflation risk. In turn, the market premium for the 10-year yield may trend higher again as the crowd prioritizes forward-looking political risk factors over backward looking macro data, which informs the fair value estimate.

Although many economists are forecasting higher inflation driven by Trumponomics, some analysts express doubts.

“We remain highly skeptical that the Republicans will deliver any large fiscal stimulus,” says Paul Ashworth, the chief US strategist at Capital Economics. “The bottom line is that without a filibuster-proof majority in the Senate, Trump will be forced to rely on the convoluted budget reconciliation process. Republicans will have their hands full simply avoiding the coming fiscal cliff and the need to extend the original Trump tax cuts before they expire at end-2025.”

Dario Perkins, head of global macro at TS Lombard, adds: ““We suspect that the Trump reflation trade will eventually fizzle out, just as it did after 2016.”

Perhaps, but until the market agrees, there’s room for debate. For the moment, the 10-year yield – arguably the best proxy for gauging sentiment on the so-called Trump trade – continues price in higher inflation risk.

The benchmark rate rose to 4.47% on Wednesday (Nov. 13), the highest since July. To the extent that the Trump trade re: inflation is fading, the 10-year yield will stabilize if not decline.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno