Macro Briefing: 13 January 2025

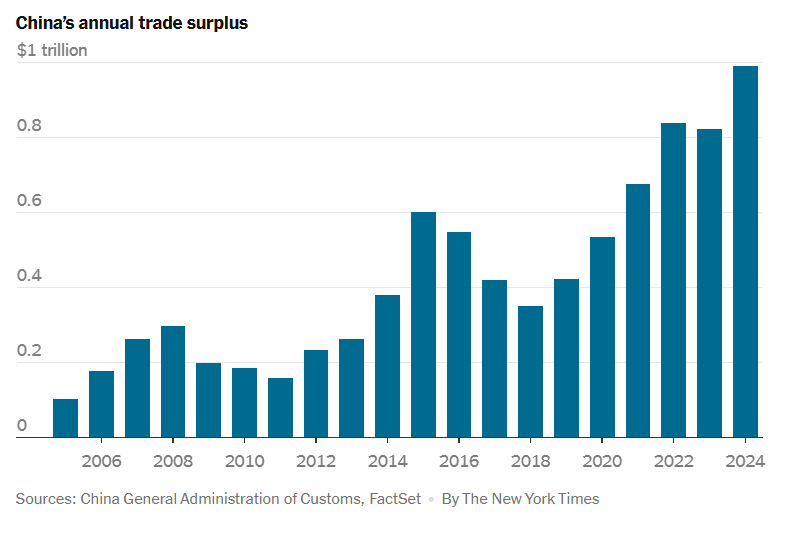

Driven by strong exports, the news arrives ahead of expected US policy changes on import tariffs after President-elect Trump moves into the White House on Jan… The gain marks the strongest monthly advance since March…China’s trade surplus surged to nearly $1 trillion in 2024… The New York T…

China’s trade surplus surged to nearly $1 trillion in 2024. Driven by strong exports, the news arrives ahead of expected US policy changes on import tariffs after President-elect Trump moves into the White House on Jan. 20. The New York Times reports: “When adjusted for inflation, China’s trade surplus last year far exceeded any in the world in the past century, even those of export powerhouses like Germany, Japan or the United States. Chinese factories are dominating global manufacturing on a scale not experienced by any country since the United States after World War II.”

Goldman Sachs strategists predict that the sliding China stock market will eventually rally about 20% this year. The outlook currently looks challenged after the MSCI China Index fell into a bear market last week and the CSI 300 benchmark shed more than 5% in 2025’s first seven trading sessions — the worst start to a calendar year since 2016, Yahoo Finance reports.

Investors are wondering if the upcoming earnings seasons will provide support for the faltering US stock market, which has slipped 0.9% year to date. “This fourth-quarter earnings season is probably one of the most consequential earnings seasons that we’re going to see in a long time,” says Larry Adam, chief investment officer at Raymond James.

US nonfarm payrolls rose more than expected in December, advancing 256,000 vs. the previous month. The gain marks the strongest monthly advance since March. The report points to “a resilient economy and suggesting that the Fed may be on hold for longer than previously anticipated,” advises Haver Analytics.

Author: James Picerno