3 key Ethereum price metrics suggest that ETH is gearing up for volatility

Network, futures and user data all point toward Ethereum potentially charting a new course… Ether (ETH) price has been dealing with some strong headwinds and on Sept… In the days that followed, Ether managed to stage an impressive rec…

Network, futures and user data all point toward Ethereum potentially charting a new course.

Ether (ETH) price has been dealing with some strong headwinds and on Sept. 11, the price of the altcoin endured a critical test when it plunged to the $1,530 support level. In the days that followed, Ether managed to stage an impressive recovery, by surging by 6%. This resurgence may signal a pivotal moment, following a month that had seen ETH endure losses of 16%.

Even with the somewhat swift recovery, Ether’s price performance raises questions among investors about whether it has the potential to climb back to $1,850, and ETH derivatives and network activity might hold the key to this puzzle.

Macroeconomic factors have played a significant role in mitigating investor pessimism given that inflation in the United States accelerated for the second consecutive month, reaching 3.7% according to the most recent CPI report. Such data reinforces the belief that the U.S. government’s debt will continue to surge, compelling the Treasury to offer higher yields.

Scarce assets are poised to benefit from the inflationary pressure and the expansive monetary policies aimed at bridging the budget deficit. However, the cryptocurrency sector is grappling with its own set of challenges.

Regulatory uncertainty and high network fees limit investors’ appetite

There’s the looming possibility of Binance exchange facing indictment by the U.S. Department of Justice. Furthermore, Binance.US has found itself entangled in legal battles with the U.S. Securities and Exchange Commission (SEC), leading to layoffs and top executives departing from the company.

Besides the regulatory hurdles faced by cryptocurrencies, the Ethereum network has witnessed a notable decline in its smart contract activity, which is at the core of its original purpose. The network still grapples with persistently high average fees, hovering above the $3 mark.

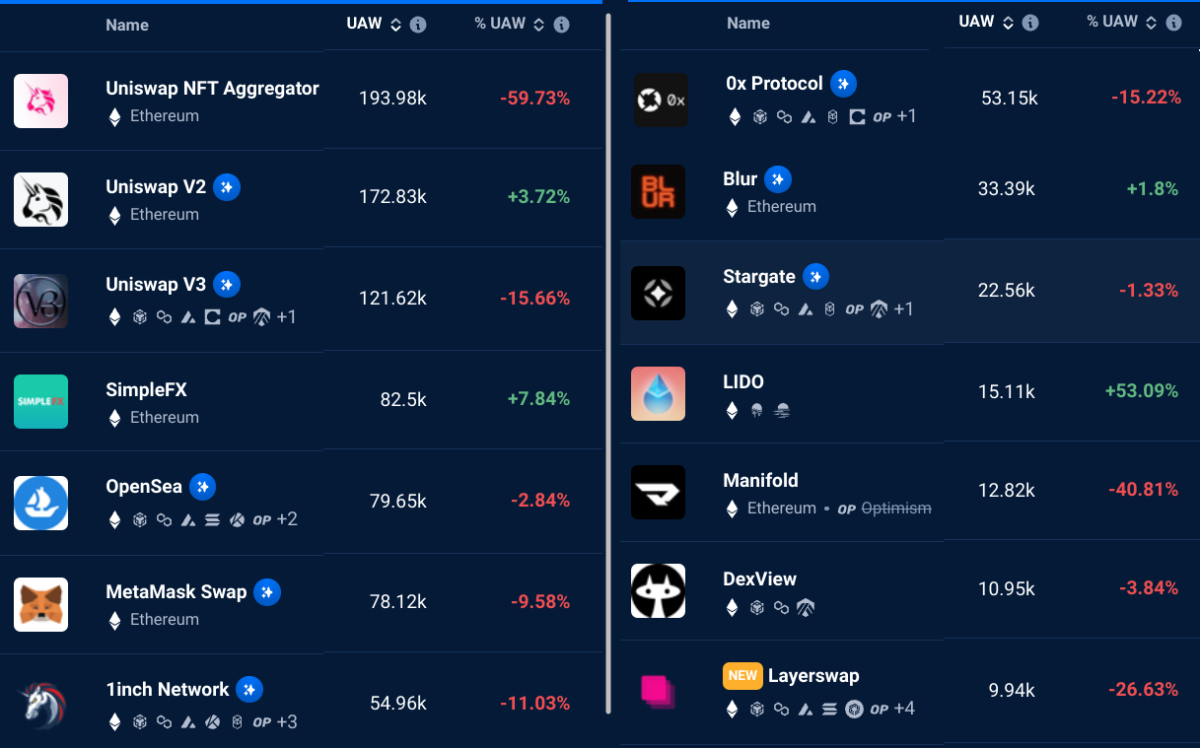

Over the past 30 days, the top Ethereum dApps have seen an average 26% decrease in the number of active addresses. An exception to this trend is the Lido (LDO) liquid staking project, which saw a 7% increase in its total value locked (TVL) in ETH terms during the same period. It’s worth mentioning that Lido’s success has been met with criticism due to the project’s dominance, accounting for a substantial 72% of all staked ETH.

Vitalik Buterin, co-founder of Ethereum, has acknowledged the need for Ethereum to become more accessible for everyday people to run nodes in order to maintain decentralization in the long term. However, Vitalik does not anticipate a viable solution to this challenge within the next decade. Consequently, investors have legitimate concerns about centralization, including the influence of services like Lido.

ETH futures and options show reduced interest from leverage longs

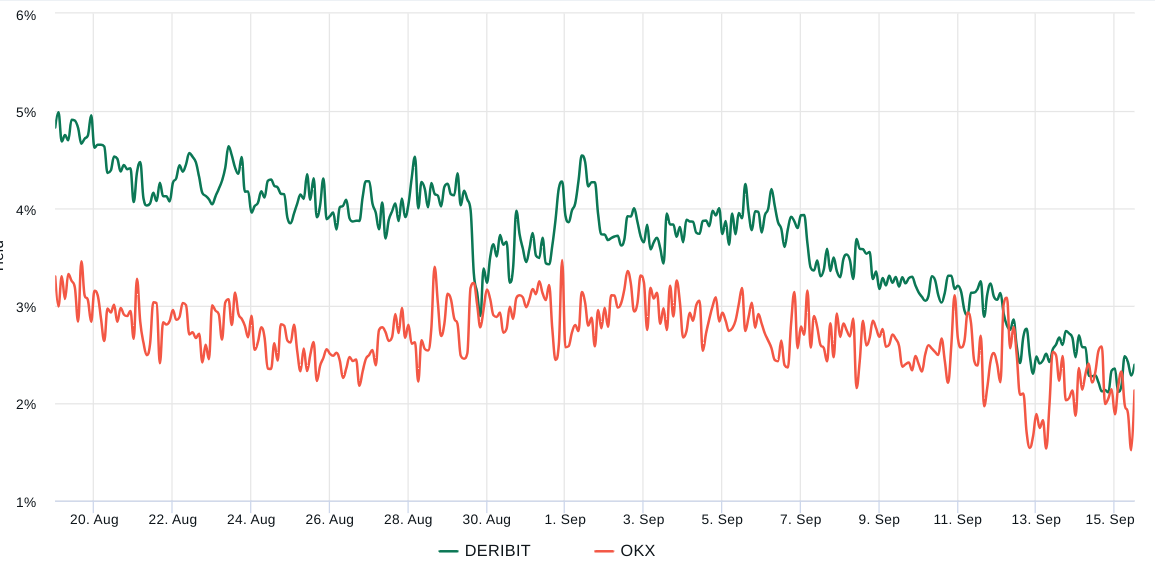

A look at derivatives metrics will better explain how Ether’s professional traders are positioned in the current market conditions. Ether monthly futures typically trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

The premium for Ether futures hit its lowest point in three weeks, standing at 2.2%, indicating a lack of demand for leveraged long positions. Interestingly, not even the 6% gain following the retest of the $1,530 support level on Sept. 11 managed to push ETH futures into the 5% neutral threshold.

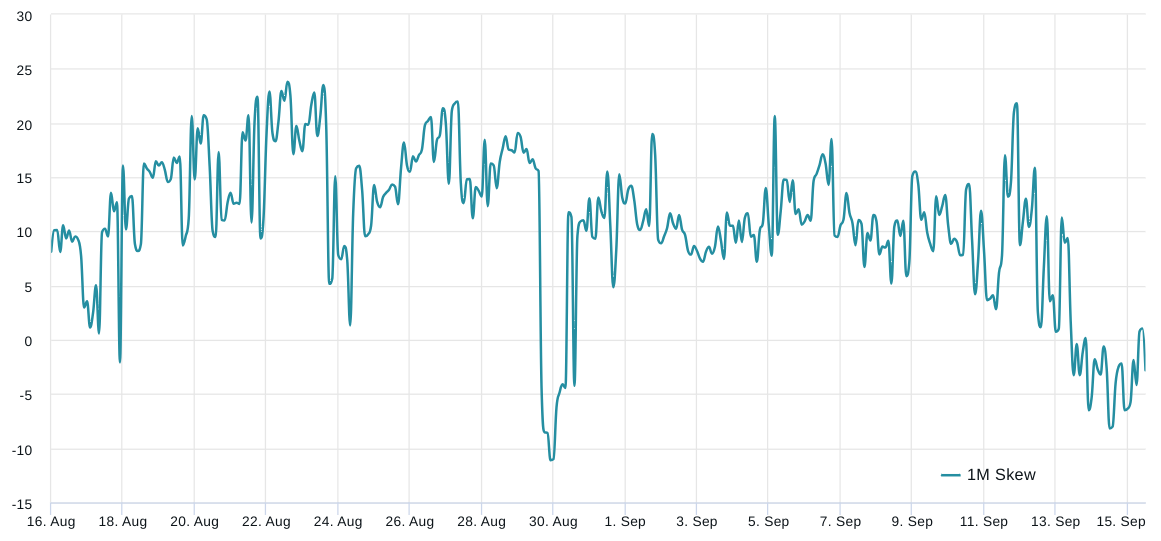

One should look at the options markets to better gauge market sentiment, as the 25% delta skew can confirm whether professional traders are leaning bearish. In short, if traders expect a drop in Bitcoin’s price, the skew metric will rise above 7%, while periods of excitement typically have a -7% skew.

On Sept. 14 the Ether 25% delta skew indicator briefly shifted to a bullish stance. This shift was driven by put (sell) options trading at an 8% discount compared to similar call (buy) options. However, this sentiment waned on Sept. 15, with both call and put options now trading at a similar premium. Essentially, Ether derivatives traders are displaying reduced interest in leverage long positions, despite the successful defense of the $1,530 price level.

On one hand, Ether has potential catalysts, including requests for a spot ETH exchange-traded fund (ETF) and macroeconomic factors driven by inflationary pressure. However, the dwindling use of dApps and ongoing regulatory uncertainties create a fertile ground for FUD. This is likely to continue exerting downward pressure on Ether’s price, making a rally to $1,850 in the short to medium term appear unlikely.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Author: Marcel Pechman