Risk-On Momentum Prevails As February Winds Down

Trends have a shelf life, but it’s not yet obvious that the expiration date is today…Focusing on the US equities market tells a similar story as the ratio US stocks (SPY) vs… A sharp break lower for this ratio would signal a change in sentiment for the worse, but optimists prefer to s…

The premise of the momentum factor draws on an empirical fact: price trends persist… until they don’t. The latter point is the tricky part and so it’s never quite clear when the party will end and a trend reverses. But based on the numbers through yesterday’s close (Feb. 28), it’s fair to stay that the crowd’s appetite for risk endured for another month in February, extending 2024’s upbeat kick-off in January via a set of ETF pairs that serve as risk proxies. Trends have a shelf life, but it’s not yet obvious that the expiration date is today.

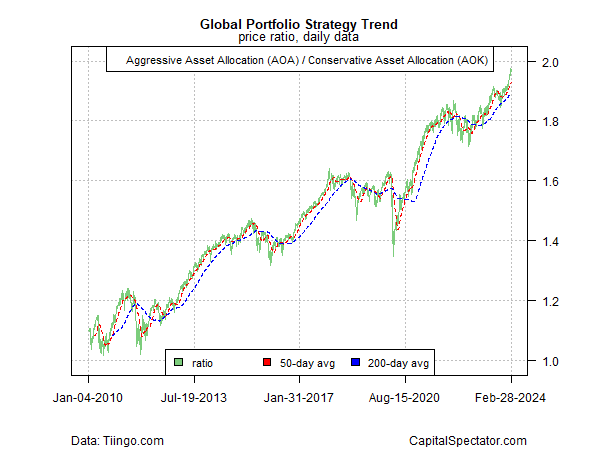

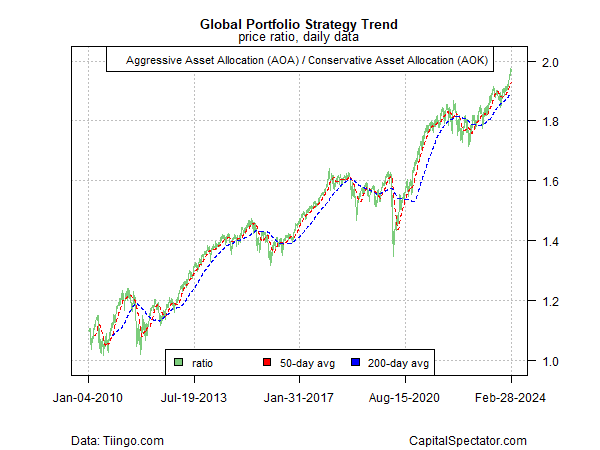

Let’s start with a measure of global markets with as profiled an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). This measure touched a new peak in recent days and continues to show a clear upside bias.

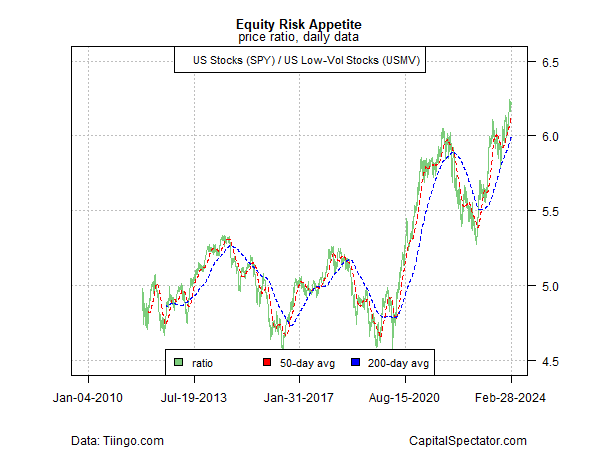

Focusing on the US equities market tells a similar story as the ratio US stocks (SPY) vs. a low-volatility subset (USMV) continues to soar.

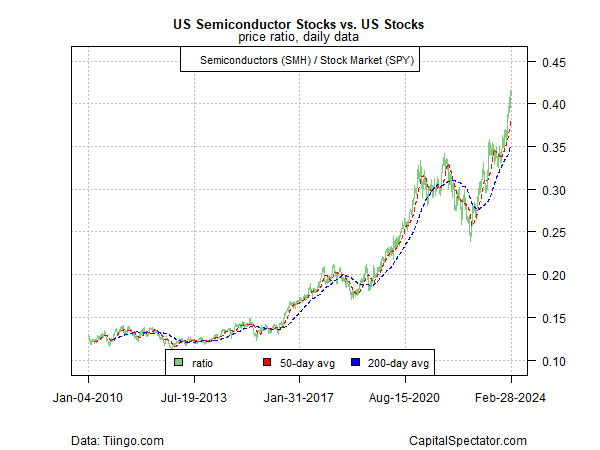

A crucial engine of bullish power flows from the surge in semiconductor shares (SMH) — considered a business-cycle proxy — vs. the broad US equities market (SPY).

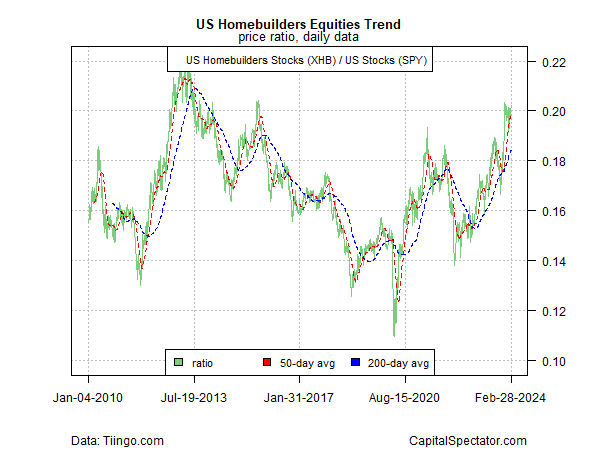

A possible warning sign for the bulls may be emerging in housing stocks (XHB), although for now this industry continues to hold on to strong gains vs. the broad market (SPY). A sharp break lower for this ratio would signal a change in sentiment for the worse, but optimists prefer to see the recent flatlining for this ratio as a consolidation of previous gains vs. a warning sign.

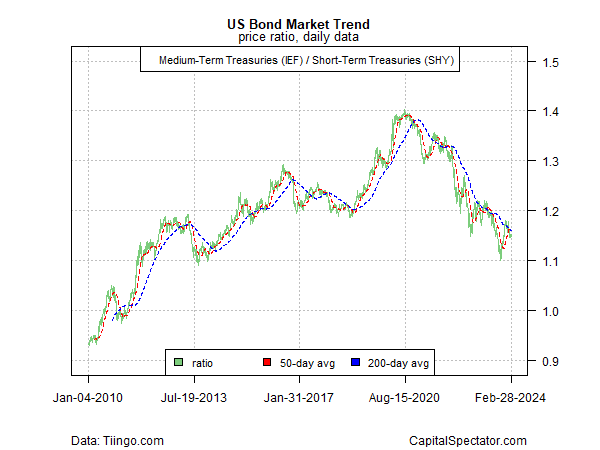

Meanwhile, the risk appetite for US Treasuries (IEF) relative to short-term government securities (SHY) continues to skew negative after the latest attempt at breaking the downtrend failed.

What might kill the bullish momentum for equities? There’s no shortage of possibilities, including hotter-than-expected inflation reports and another delay in the guesstimates for the start of interest-rate cuts by the Federal Reserve. Based on the upside trend in risk appetite, however, the crowd still sees those killjoy events as low-probability threats for the near term, despite the fact that the market has been disappointed on those fronts several times already.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno