Macro Briefing: 8 March 2024

* Fed’s Powell says central bank “not far” from cutting rates, but… * Powell also says “there will be bank failures” due to commercial property losses * US consumer borrowing rose more than expected in January * US trade deficit widens in January to largest gap in nine months * US jobles…

* Fed’s Powell says central bank “not far” from cutting rates, but…

* Powell also says “there will be bank failures” due to commercial property losses

* US consumer borrowing rose more than expected in January

* US trade deficit widens in January to largest gap in nine months

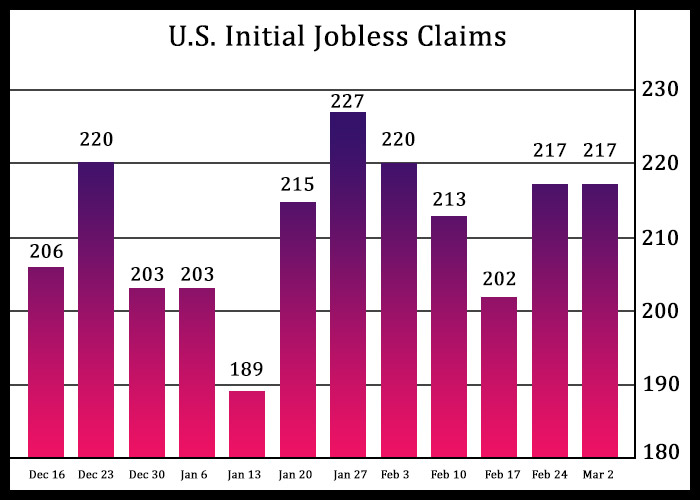

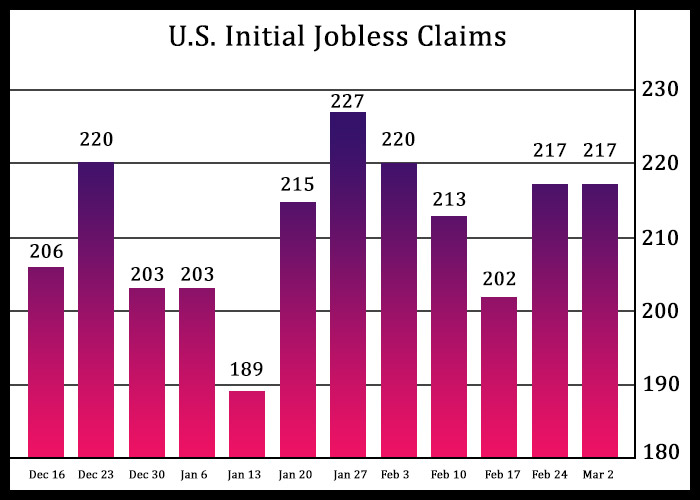

* US jobless claims were unchanged last week, holding at a low level:

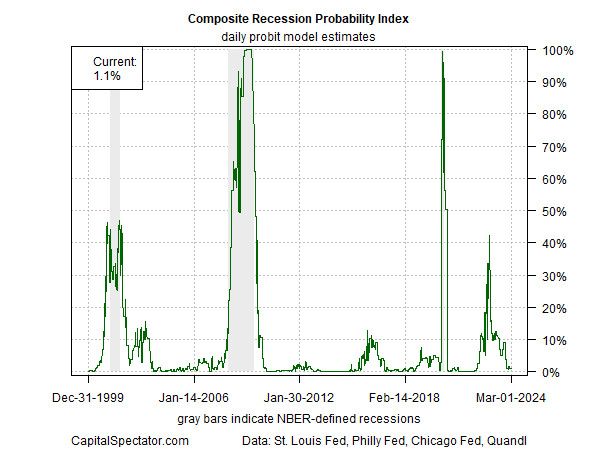

Fed Chair Jerome Powell says US recession risk is low. In testimony in Congress this week, he advises “there’s no evidence or no reason to think that the US economy is in some kind of short-term risk of falling into recession.” Powell’s view aligns with the long-running low-recession estimate published in the weekly updates of The US Business Cycle Risk Report, a sister publication of CapitalSpectator.com. The Composite Recession Probability Index, a multi-factor business-cycle benchmark, estimated a virtually nil chance that the US was in an NBER-defined recession as of March 1.

Author: James Picerno