US Q1 GDP Nowcast Highlights Growth Slowdown Persisting

US economic output is still on a path for a materially softer pace of growth in the first-quarter GDP report scheduled for release at the end of this month… This moderate rise in economic activity, if correct, will mark a downshift in growth from Q4’s strong 3…Although US growth has slowed…

US economic output is still on a path for a materially softer pace of growth in the first-quarter GDP report scheduled for release at the end of this month. The expansion will be strong enough to minimize recession risk, but the deceleration in the trend via GDP data will remain conspicuous for a second straight quarterly update.

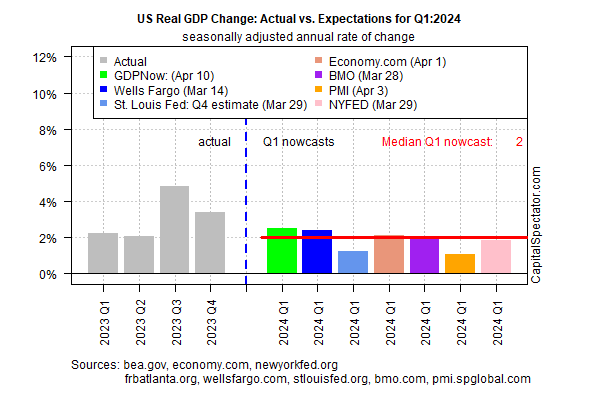

Output for the January-through-March period is currently estimated at a 2.0% increase (seasonally adjusted real annual rate), based on the median for a set of nowcasts compiled by CapitalSpectator.com. This moderate rise in economic activity, if correct, will mark a downshift in growth from Q4’s strong 3.4% advance, which was a downshift from Q3.

Today’s 2.0% median increase for Q1 GDP is unchanged from the previous nowcast on Mar. 22. The recent stability of these revisions suggests, at this late date, ahead of the release of the government’s Q1 GDP report on Apr. 25, that a 2% nowcast is a reasonable guesstimate.

Although US growth has slowed, and is expected to decelerate further in the upcoming Q1 GDP report, one view of this downshift is that the economy is stabilizing at a sustainable, “normal” pace rather than descending toward a recession later in the year.

Favoring this view is Chris Williamson, chief business economist at S&P Global Market Intelligence. Citing revised PMI survey data for March, published earlier this week and included in the GDP nowcast data above, he says:

“Combined with an acceleration of growth in the manufacturing sector, the latest services PMI data point to GDP having risen at an approximate 2% annualized rate in the first three months of the year. Confidence in the outlook for the coming year has also lifted higher, which should help to sustain solid growth into the second quarter.”

JP Morgan also sees low recession risk in the near term. A recent research note from the bank’s trading desk advises that a downturn appears unlikely in 2024. Meredith Whitney, founder and CEO at Meredith Whitney Advisory Group, also expects US growth to continue through the end of the year.

Count Goldman Sachs Chief Economist Jan Hatzius among the optimists. He sees a growth bias persisting for the US economy, telling CNBC: “I’m certainly optimistic on this year. On the growth side, we’re well above consensus, close to 3% growth this year.” Meanwhile, “We’re well below consensus in terms of the risk of a recession. We think 15% over the next 12 months, which is sort of average recession probability, since we’ve had a recession about once every seven years in the post-war period.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno