Macro Briefing: 29 April 2024

* Weak US Q1 GDP report masks underlying strength: Wells Fargo * US Fed meeting this week arrives as summer rate cut expectations fade * Are wealthy older Americans fueling growth and helping delay rate cuts? * Higher estimates of neutral rate suggests the days of low interest rates is over * US con…

* Weak US Q1 GDP report masks underlying strength: Wells Fargo

* US Fed meeting this week arrives as summer rate cut expectations fade

* Are wealthy older Americans fueling growth and helping delay rate cuts?

* Higher estimates of neutral rate suggests the days of low interest rates is over

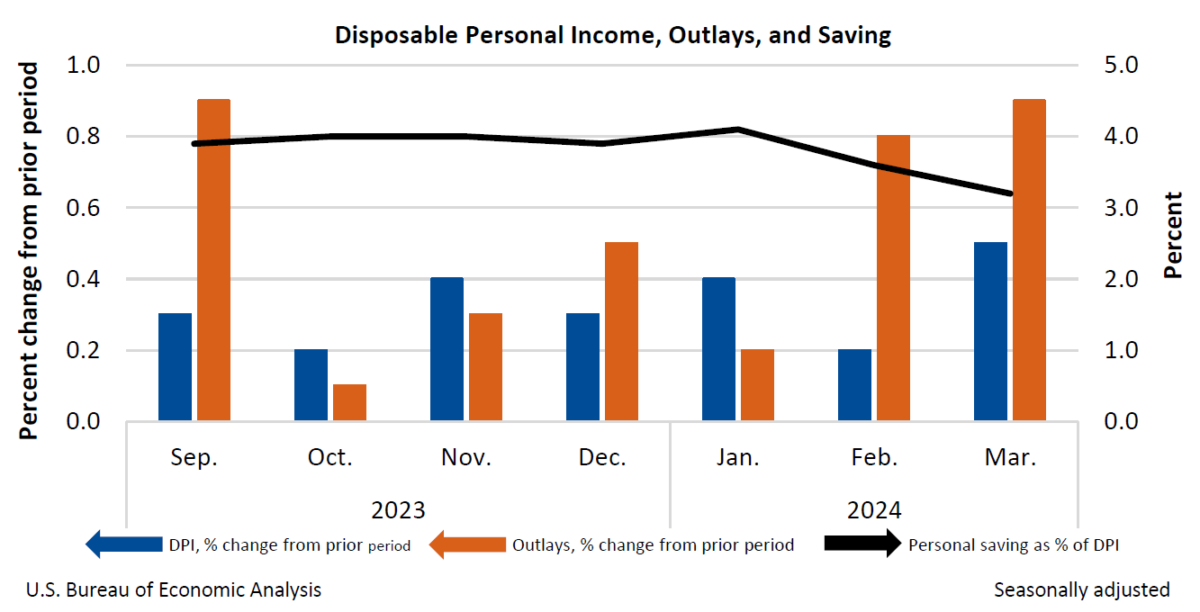

* US consumer spending increased more than forecast in March:

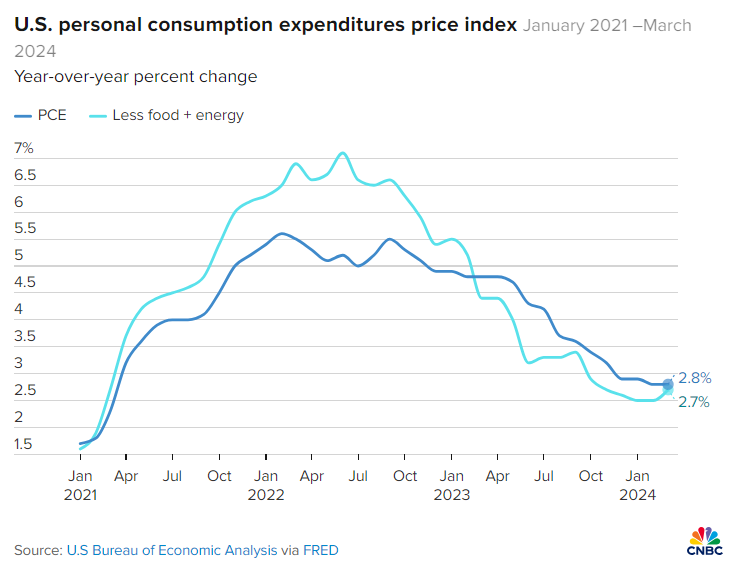

US inflation, measured by the personal consumption expenditures price index, was sticky in March. Headline PCE edged up in year-over-year terms to 2.7% while core PCE was steady at 2.8%. On both counts, the inflation rate was still well above the Fed’s 2% target. “Just spending a lot of money is creating demand, it’s creating stimulus. With unemployment under 4%, it shouldn’t be that surprising that prices aren’t” going down, says Joseph LaVorgna, chief economist at SMBC Nikko Securities. “Spending numbers aren’t going down anytime soon. So you might have a sticky inflation scenario.”

Author: James Picerno