Macro Briefing: 9 May 2024

* Boston Fed president joins the view that rates will stay higher for longer * China’s factory glut alarms the world, but easy fixes are nowhere on the horizon * China’s imports surge in April, beating expectations by wide margin * Americans reduced credit card debt sharply in March * US stocks …

* Boston Fed president joins the view that rates will stay higher for longer

* China’s factory glut alarms the world, but easy fixes are nowhere on the horizon

* China’s imports surge in April, beating expectations by wide margin

* Americans reduced credit card debt sharply in March

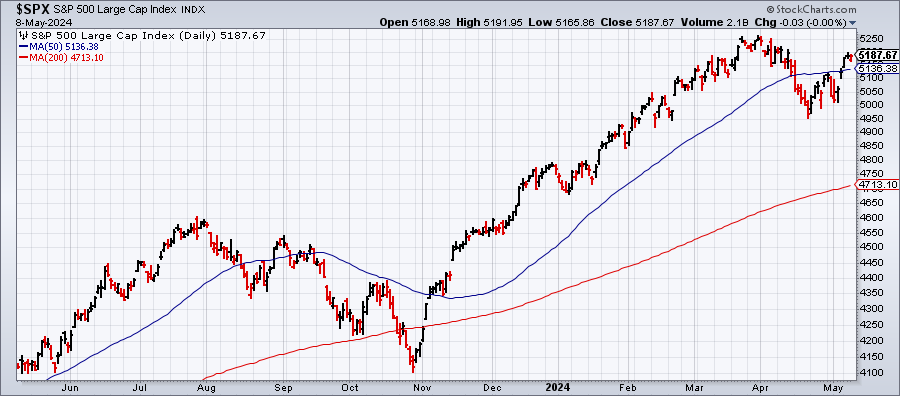

* US stocks (S&P 500) pull back, still trading below record high set in March:

Emerging markets junk bonds are the leading performer for sovereign debt markets this year. “Emerging markets have done much better than anyone would have expected,” says David Hauner, head of global emerging markets fixed income strategy at Bank of America. “Clearly the credit component of EM sovereign bonds has held up well because the fundamentals have been improving.” Year to date, an ETF targeting high-yield EM bonds (EMHY) is outperforming a broader EM government bond fund (EMLC) and a developed-markets government bond fund ex-US (BWX):

Author: James Picerno