Fed Funds Futures Market Starts To Flirt With Rate Hike Possibility

12) will leave rates unchanged, although the slight possibility of a rate hike is peeking out with a 1… These participants saw this uncertainty as coming from the possibility that high interest rates may be having smaller effects than in the past, that longer-run equilibrium interest rates may be…

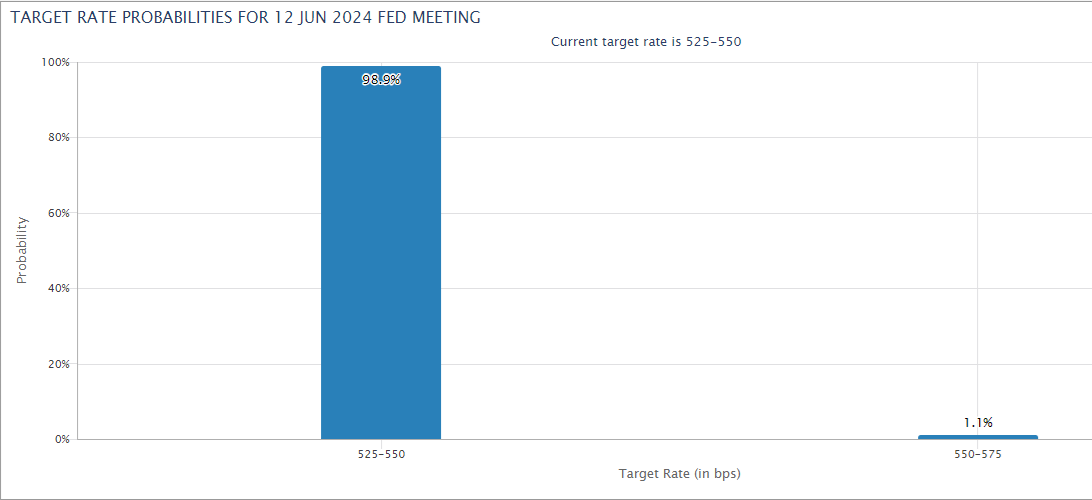

The monetary policy outlook has been uncertain, but primarily in terms of the timing of the first rate cut. But that’s starting to change as Fed funds futures price in the possibility of a rate hike. To be clear, the implied probability for a hike is extremely low: no more than 1%. But the fact that market sentiment is pricing in any chance of a hike marks a shift.

It’s debatable if this shift is significant or just market noise. As for the central bank, Fed policymakers have communicated in recent months that rate hikes are unlikely while remaining cagey about the timing of rate cuts. Fed funds futures still don’t communicate any conflict with that outlook – the priced-in probabilities are still overwhelmingly skewing to no change or rate cuts for the next several FOMC meetings. For example, the market is estimating a roughly 50% probability for a rate cut at the Sep. 18 FOMC meeting, according to CME data. Meanwhile, confidence is high that the next Fed meeting (Jun. 12) will leave rates unchanged, although the slight possibility of a rate hike is peeking out with a 1.1% implied probability.

The policy-sensitive US 2-year Treasury yield is also pricing in a lower Fed funds target rate, which is currently 5.25% to 5.50%. By contrast, the 2-year yield yesterday (May 23) traded moderately lower at 4.91%. To be fair, the 2-year rate has been anticipating a rate cut for more than a year. In any case, this widely followed rate suggests the crowd is still erring on the side of rate cuts vs. hikes as the next policy change.

In recent days, however, economic data suggests the economy remains resilient, which suggests that it’s premature to dismiss the possibility of rate cut. Notably, PMI survey data for May indicates that the US economy rebounded sharply after April weakness. Meanwhile, jobless claims remain low, which implies that the labor market will continue to expand at a healthy pace in the near term.

The key variable is the path of inflation. The latest numbers show renewed signs of progress with disinflation, but the latest Fed minutes remind that while rate hikes are still a very low probability, the possibility is on the minds of policymakers, or so it appears if you read between the lines in the latest review of the May 30-Apr. 1 FOMC meeting:

Participants remained highly attentive to inflation risks and noted the uncertainty associated with the economic outlook. Although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness. These participants saw this uncertainty as coming from the possibility that high interest rates may be having smaller effects than in the past, that longer-run equilibrium interest rates may be higher than previously thought, or that the level of potential output may be lower than estimated. Participants assessed, however, that monetary policy remained well positioned to respond to evolving economic conditions and risks to the outlook.

The idea of a rate hike is subtle via the minutes and the commentary overall still skews heavily toward standing pat at most – echoing Fed funds futures. But the fact Fed officials and futures are starting to explore the possibility for more policy tightening adds a new risk factor, however slight, to consider for the macro outlook.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno