Macro Briefing: 29 May 2024

* Robust earnings outlook is a key factor for stock market optimism * IMF lifts China economic forecast to 5%, up from 4…6% * US consumer confidence index rises in May–first increase in four months * Low stock market volatility may be underpricing risk * Texas manufacturing activity weakens slig…

* Robust earnings outlook is a key factor for stock market optimism

* IMF lifts China economic forecast to 5%, up from 4.6%

* US consumer confidence index rises in May–first increase in four months

* Low stock market volatility may be underpricing risk

* Texas manufacturing activity weakens slightly in May

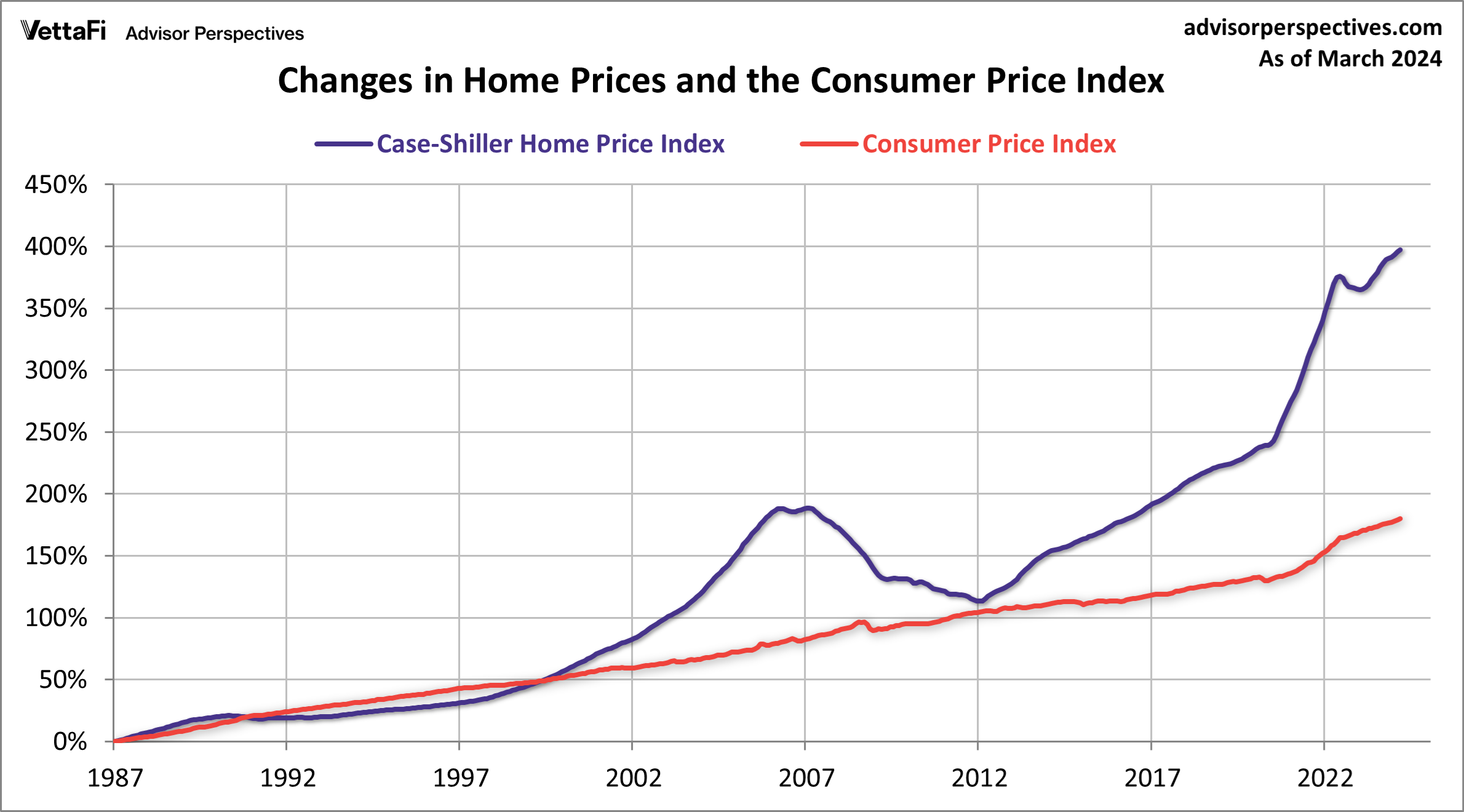

* US home prices rise to a new record high in March:

First-quarter earnings growth for the S&P 500 Index has been “excellent,” reports LPL Financial, and “earnings are currently growing at a solid mid-to-high-single-digit pace with a realistic opportunity for even stronger growth in the coming quarters.” The research division of the wealth management firm advises: “Economic growth is supportive. Wage pressures seem to be stabilizing as the job market loosens up a bit. Consumer prices are increasing at a faster pace than wholesale prices, using the latest readings for the Consumer Price Index (CPI) and Producer Price Index (PPI), which supports margins. And margins in healthcare and energy are depressed and poised to reverse. One risk is further consumer pushback on high prices as savings dwindle. Higher commodity and borrowing costs present other potential headwinds.”

Author: James Picerno