Will Fed’s Preferred Inflation Gauge Tick Lower In Friday’s Update?

Tomorrow’s update on US inflation for April looks set to tick lower, although the odds aren’t trivial that pricing pressure will remains sticky, according to various forecasts and a review of pricing trends published to date… Disinflation is still intact, based on numbers in hand, but the repo…

Tomorrow’s update on US inflation for April looks set to tick lower, although the odds aren’t trivial that pricing pressure will remains sticky, according to various forecasts and a review of pricing trends published to date. Disinflation is still intact, based on numbers in hand, but the report scheduled for Friday, May 31, will probably show limited progress on taming inflation.

Economists see a mixed picture for PCE price index data for April. For the monthly comparison, headline PCE inflation is expected to hold steady at a 0.3% pace while core PCE (considered to be the Fed’s preferred inflation benchmark) is projected to tick down to 0.2%, according to Econoday.com. More worrisome is the crowd’s view that headline and core PCE for the one-year change will stay at 2.7% and 2.8%, respectively – unchanged from March.

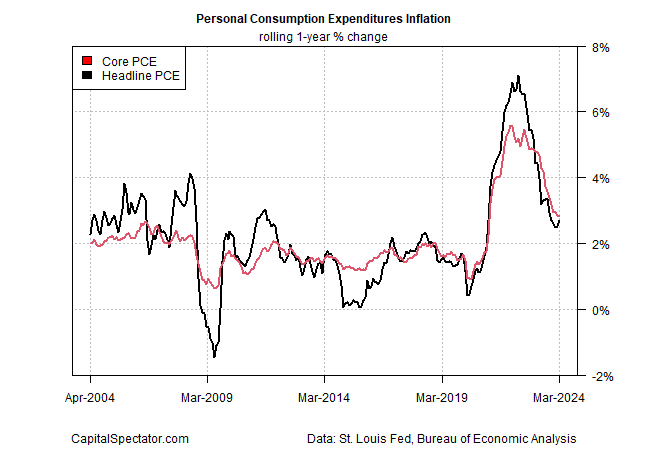

PCE inflation’s downside bias will likely continue in the months ahead, but progress has stalled recently, as the one-year chart for headline and core PCE through March shows:

“We will need to accumulate further data over the coming months to have a clearer picture of the inflation outlook,” Loretta Mester, president of Federal Reserve Bank of Cleveland, advised earlier this month. A voting member of the interest-rate policy committee, she added: “I now believe that it will take longer to reach our 2% goal than I previously thought.”

Tomorrow’s PCE inflation data will probably reaffirm her outlook. Nonetheless, a review of several inflation metrics still implies that the disinflation trend will roll on, albeit slowly and in fits and starts.

Consider that the average of seven variations of inflation metrics published by the Fed show a flat-to-modest downside bias through April. That’s a reminder that the inflation bias remains sticky but reflation risk still looks low.

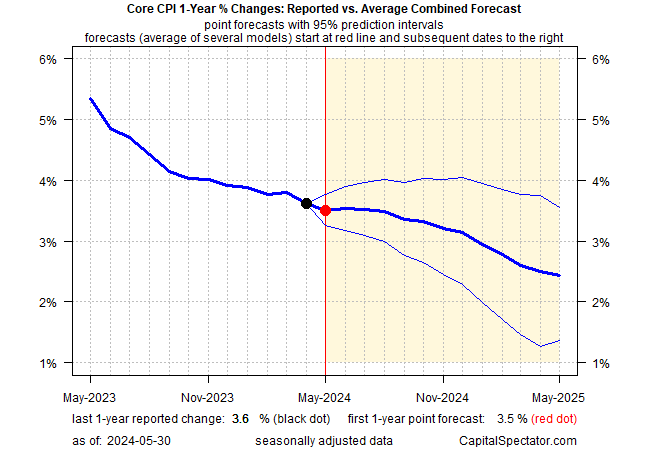

Looking ahead, CapitalSpectator.com’s inflation-forecasting model for the 1-year change in the core consumer price index still projects that sluggish disinflation will continue.

One thing that has changed, and continues to evolve: expectations for the first rate cut of this cycle. In mid-April, Fed funds futures were pricing in a 70% probability of a rate cut at the Sep. 18 FOMC meeting. The calculus is now a coin flip and the November 7 meeting is currently the best guess for a possible change in policy at the earliest, according to CME data.

Atlanta Fed President Raphael Bostic offers a ray of hope for the doves. Speaking at a conference yesterday (May 29), he advised that several inflation metrics are still moving toward the central bank’s target range and that a rate cut is still a possibility at some point in this year’s fourth quarter.

The bottom line: until inflation moves closer to the Fed’s 2% target, rate cuts will continue to be postponed. Add in the complicating policy factor of the November election (and the Fed’s desire to avoid appearing to favor one candidate or another) and it’s getting easier to assume that the Dec. 18 is the new forecast for the earliest date to expect a rate cut. Tomorrow’s PCE price data isn’t likely to offer a reason to think otherwise.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno