Macro Briefing: 4 June 2024

8% via Altanta Fed’s model * Global manufacturing activity improves in May, rising to 22-month high * Weak US construction spending trend continues in April * Warren Buffett’s Berkshire Hathaway owns 3% of the US Treasury bill market * US manufacturing activity contracts for second month in May:…

* US Q2 GDP nowcast revised down, again, to +1.8% via Altanta Fed’s model

* Global manufacturing activity improves in May, rising to 22-month high

* Weak US construction spending trend continues in April

* Warren Buffett’s Berkshire Hathaway owns 3% of the US Treasury bill market

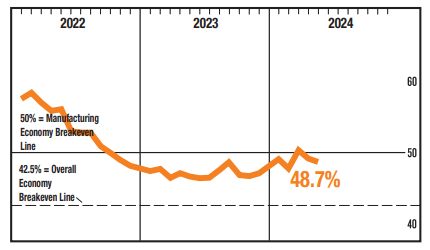

* US manufacturing activity contracts for second month in May:

Broad US money supply (M2) is rising again on a year-over-year basis — the first annual increase since November 2022, based on monthly data. Meanwhile, consumer price inflation is increasing a substantially higher rate: 3.3% through April 2024 vs. a 0.5% increase in M2 vs. the year-ago level, advises a new research note from TMC Research. The gap suggests that a disinflation bias persists, which will continue to put downward pressure on inflation in the near term. The rebound in M2’s trend from deeply negative comparisons, however, suggests that the disinflation bias may be set to fade in the months ahead.

Author: James Picerno