Is The US Bond Market Poised For Recovery?

The sharp drop in Treasury yields in recent days has revived chatter that the worst for the bond market may be over… It’s still early to confidently forecast that scenario, but the odds for recovery are looking better these days after a two-year bear market for much of the asset class following …

The sharp drop in Treasury yields in recent days has revived chatter that the worst for the bond market may be over. It’s still early to confidently forecast that scenario, but the odds for recovery are looking better these days after a two-year bear market for much of the asset class following the start of Federal Reserve rate hikes in early 2022.

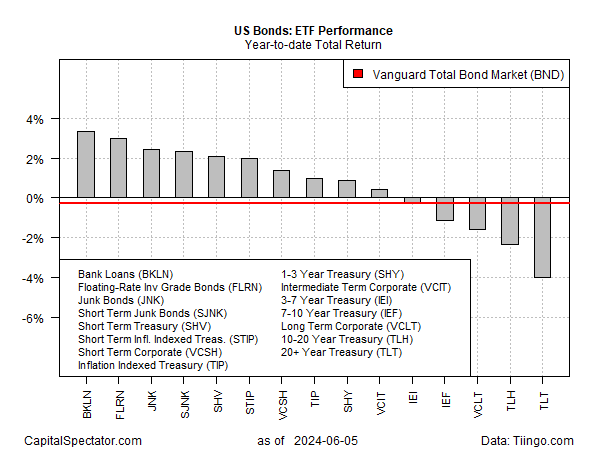

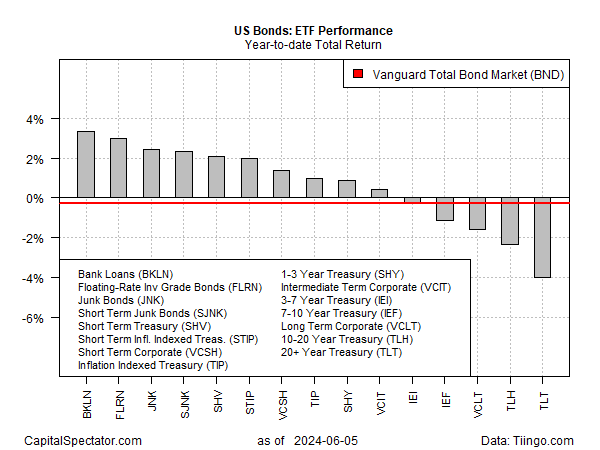

The performance profile for a wide range of US bond market niches have certainly improved lately, based on 2024 returns. The majority of sectors are now posting gains, led by Invesco Senior Loan ETF (BKLN), which is up 3.3% so far this year.

The caveat is that the year-to-date winners are mostly in low-rated and short-term securities. Meanwhile, red ink still weighs on the longer-term maturities. The steepest loss in the proxy set above is currently in long Treasuries (TLT), which is in the hole by 4% this year.

But it’s encouraging to see that firmer prices overall have trimmed losses. Notably, the US investment-grade benchmark for US bonds, proxied by Vanguard Total US Bond Market (BND), has rebounded recently, reversing a year-to-date losses in excess of -3% to a near-flat performance in 2024.

The current catalyst for optimism is the sharp drop in US Treasury yields over the past week. The 10-year Treasury yield, for instance, fell for a fifth straight day on Wednesday, tumbling to 4.28% — the lowest level in over two months.

A key factor driving yields lower is renewed concern that US economic activity is slowing, which has revived expectations that that the Federal Reserve will soon cut interest rates. Bond prices move inversely to yields and so the prospect of policy easing has revived animal spirits in the bond market. The reasoning is that if economic activity is cooling, that will provide fresh support for stronger disinflation, which has stalled lately.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

We’ve been here before, of course, and so it’s still premature to read too much into the recent slide in yields. Several key economic reports for May in the days ahead will test the bond market’s revival in positive price momentum, starting with tomorrow’s payrolls data and next week’s consumer price inflation numbers. If the incoming figures are favorable for bonds – i.e., the updates support the slowing economic and disinflation narratives – the odds will strengthen for expecting a bond market rally this summer.

Author: James Picerno