Macro Briefing: 21 June 2024

* Eurozone recovery in June slows for first time in 4 months: PMI survey* Citigroup predicts banking sector will suffer the most with AI-related job losses* Bank of England leaves rates unchanged despite inflation falling to 2% target* Electric vehicle sales slump in Europe, driven by demand slide i…

* Eurozone recovery in June slows for first time in 4 months: PMI survey

* Citigroup predicts banking sector will suffer the most with AI-related job losses

* Bank of England leaves rates unchanged despite inflation falling to 2% target

* Electric vehicle sales slump in Europe, driven by demand slide in Germany

* US jobless claims eased last week after three straight weekly increases

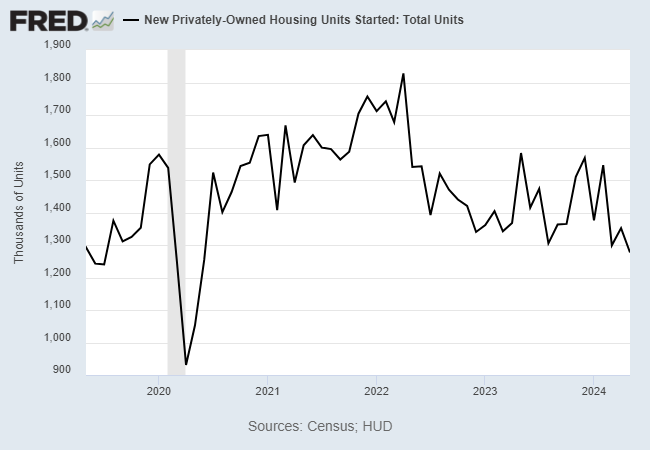

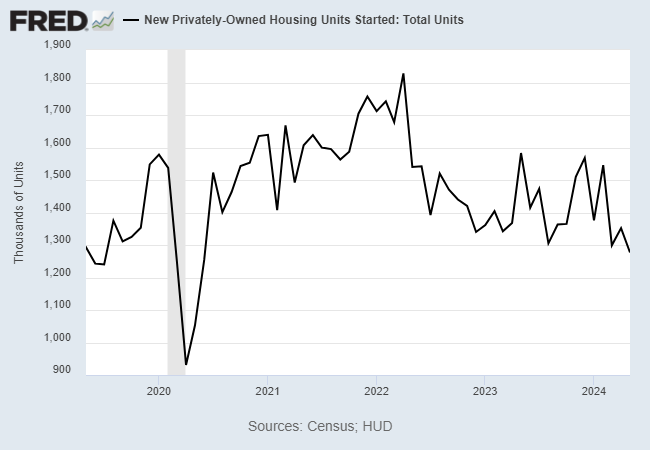

* US housing starts drop to four-year low in May:

Despite the recent rally in gold, Goldman Sachs still advises that the precious metal’s outlook is attractive as a hedge against various risks, including the upcoming US election. “We see value in long gold positions as an inflation hedge from geopolitical shock including tariffs, Fed subordination risk, and debt fears,” write analysts at the investment bank. “The upside risks to inflation appear larger under a Republican sweep,” they note.

Author: James Picerno