Macro Briefing: 10 July 2024

* Fed Chair Powell says keeping rates too high for too long threatens growth * Financial stocks lead S&P 500 to new record high * There’s a case for international investing for long-term investors * China inflation remains soft in June, reflecting weak consumer demand * China auto exports surg…

* Fed Chair Powell says keeping rates too high for too long threatens growth

* Financial stocks lead S&P 500 to new record high

* There’s a case for international investing for long-term investors

* China inflation remains soft in June, reflecting weak consumer demand

* China auto exports surge, helping offset sales slump at home

* Workers to strike indefinitely at South Korea tech giant Samsung

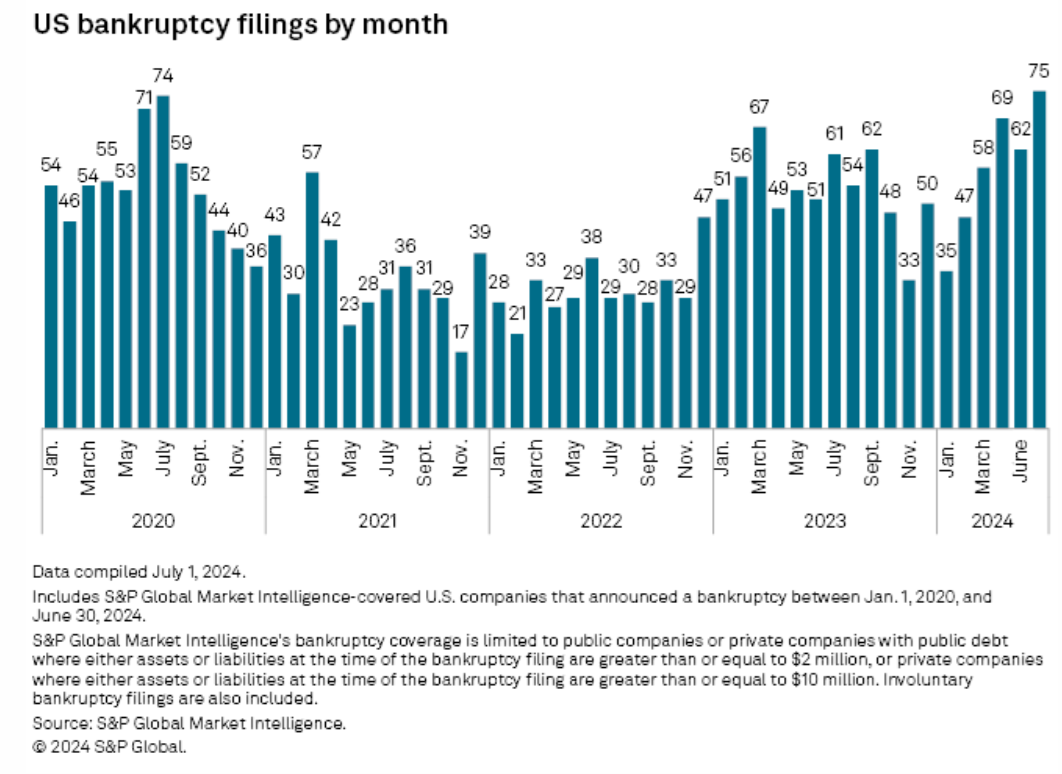

* US corporate bankruptcy filings in June rise above previous peak in 2020:

US monetary policy continues to look overly tight, based on an update of TMC Research’s Fed funds model. The report (published Tuesday, July 9) advises: “The model’s current estimate for the optimal Fed funds rate is roughly 4.75%, which is well below the current 5.25%-to-5.50% target range.” The analytics are designed to estimate the optimal Fed funds rate given the current state of five factors that are key inputs for monetary policy. On that basis, policy is overly tight, which suggests the central bank is raising the risk of slowing growth, perhaps to the point of tipping the economy into recession.

Author: James Picerno