10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 July 2024

The spread between the US 10-year Treasury yield vs…Yesterday’s sharp decline in the 10-year yield implies that the fair-value estimate’s downward pull on the market rate remains intact… Following Thursday’s news that US consumer inflation’s 1-year trend fell to 3…0% in June, the low…

The spread between the US 10-year Treasury yield vs. a ‘fair value’ estimate calculated by CapitalSpectator.com narrowed to a three-month low in June. The market-based yield is still well above this fair value estimate, but as expected in recent months (see here, for instance) the excessive market premium is still expected to slide.

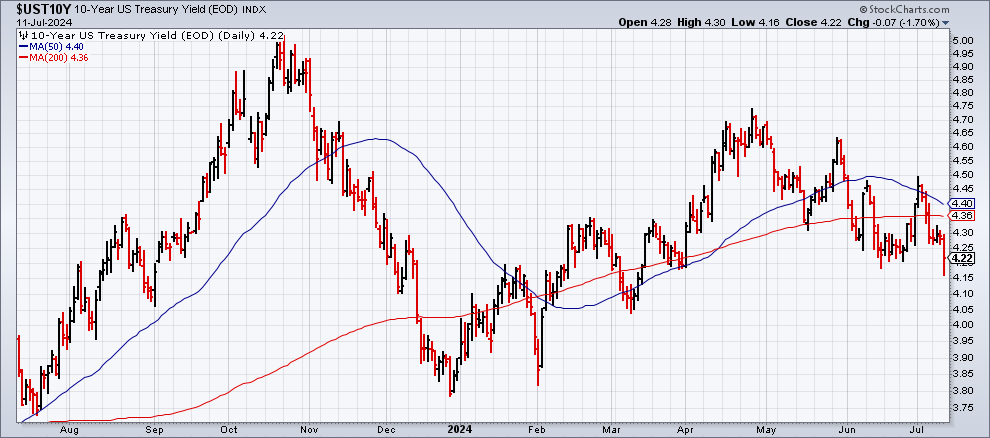

Yesterday’s sharp decline in the 10-year yield implies that the fair-value estimate’s downward pull on the market rate remains intact. Following Thursday’s news that US consumer inflation’s 1-year trend fell to 3.0% in June, the lowest in more than three years, the 10-year rate dropped to 4.22%, the lowest since late-March.

A Fed funds model I developed for TMC Research suggests that the central bank’s optimal target rate should be roughly 50 basis points lower vs. the current 5.25%-5.50% target rate. Meanwhile, Fed funds futures are pricing in a 90%-plus probability that the Fed will start cutting rates at the Sep. 18 FOMC meeting (no change is expected at the July 31 meeting). Meanwhile, the policy-sensitive 2-year yield fell sharply yesterday, dropping to 4.52%, the lowest since early March.

The main takeaway: market pressure is building in favor of lower yields. In turn, the expected narrowing of the spread for 10-year yield vs. the Capital Spectator’s fair-value estimate still looks likely unfold in the near-term future.

The current average fair-value estimate via three models is 3.40% for June, which is in line with recent monthly estimates. That estimate is 91 basis points below the actual 10-year yield for last month.

Tracking the difference in the average fair value vs. the market rate continues to reflect a substantial premium. The current differential is high, but current data shows that the spread has peaked and is poised to narrow further in the coming months, or so history suggests. Although there are periods when the market premium spikes, those events tend to be relatively brief affairs that are followed by periods of normalization, as shown in the chart below.

There’s no guarantee that history will repeat — i.e., the spread will narrow — but a variety of factors suggest that’s a reasonable forecast. Notably, there are signs that suggest that US economic growth is slowing – a critical input that, if correct, will likely push the 10-year yield lower in the weeks and months to come.

Author: James Picerno