Macro Briefing: 24 July 2024

* Several widely-monitored recession indicators “don’t work like they used to” * Trading volume tops $1 billion for debut of ether ETFs * FTC launches probe into ‘surveillance pricing’ that rapidly changes prices * Eurozone business activity is nearly at standstill in July: PMI survey * US…

* Several widely-monitored recession indicators “don’t work like they used to”

* Trading volume tops $1 billion for debut of ether ETFs

* FTC launches probe into ‘surveillance pricing’ that rapidly changes prices

* Eurozone business activity is nearly at standstill in July: PMI survey

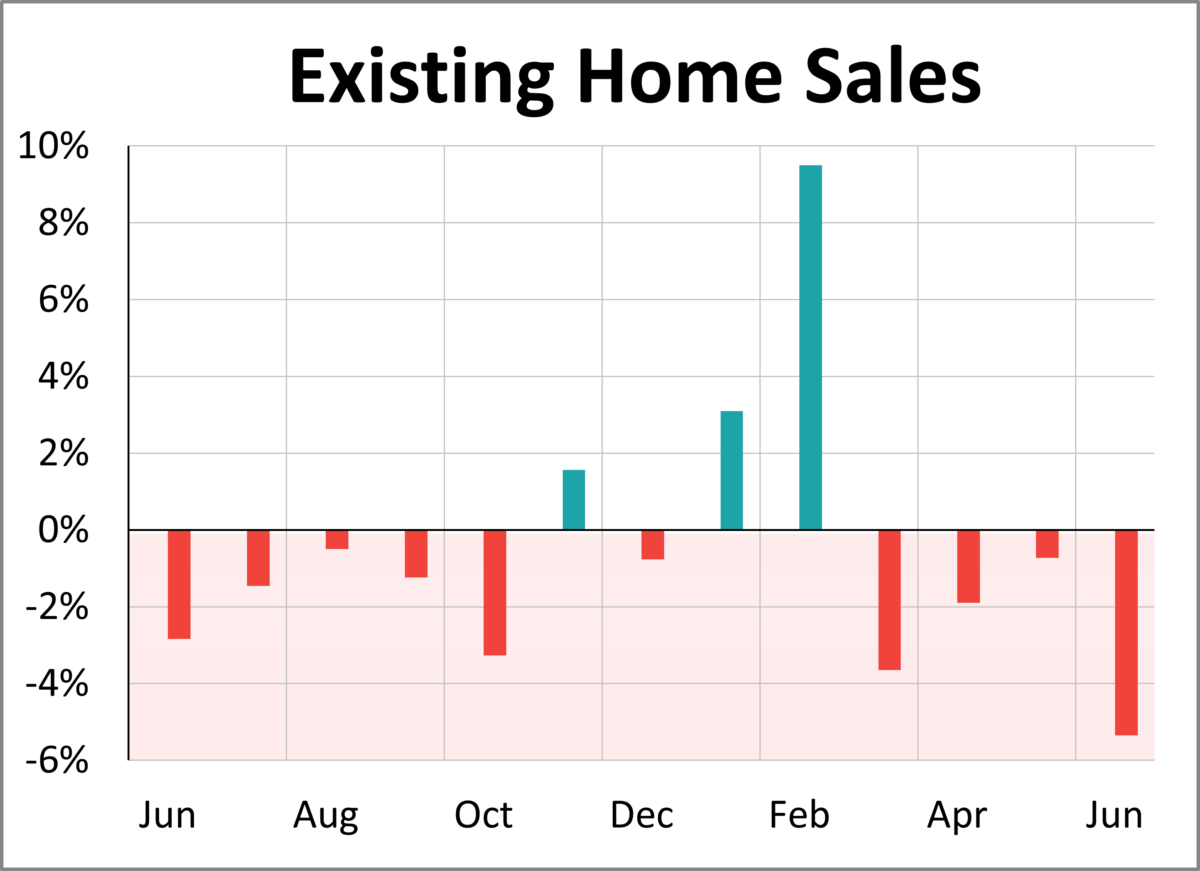

* US existing home sales fell for fourth month in June:

The real (inflation-adjusted) Fed funds rate is at a 17-year high, which is a factor suggesting that the central bank will soon start cutting rates. “Relatively sharp increases in the real Fed funds rate tend to be associated with the start of rate-cutting cycles,” advises a note from TMC Research, a division of The Milwaukee Company, a wealth manager. “That’s no guarantee that a rate cut is near, but it tips the scale in that direction by more than a trivial degree.”

Author: James Picerno