10-Year US Treasury Yield ‘Fair Value’ Estimate: 15 August 2024

The spread between the US 10-year Treasury yield and a ‘fair value’ estimate calculated by CapitalSpectator… The market rate is still well above the model’s estimate, but as explained in recent months (see the analysis from March, for instance) the premium remains on track to ease…com’s …

The spread between the US 10-year Treasury yield and a ‘fair value’ estimate calculated by CapitalSpectator.com continued to narrow in July. The market rate is still well above the model’s estimate, but as explained in recent months (see the analysis from March, for instance) the premium remains on track to ease.

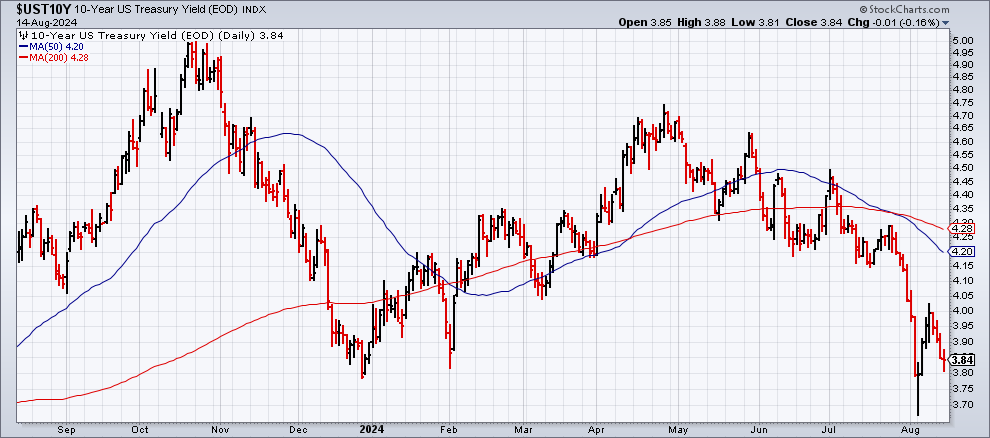

For context, let’s start with the benchmark rate in the market: the 10-year yield closed yesterday (Aug. 14) at 3.84%, which is close to the lowest level in more than a year.

Although it’s obvious now, CapitalSpectator.com’s multi-factor fair-value model has been predicting for some time that the relatively wide spread between the market rate and the average model estimate would narrow. The main uncertainty has been and remains: the mechanism for the narrowing. Would the spread differential decline due to a lower market rate, a rising model estimate, or a combination of both?

What is clear is that the high spread, as predicted, has once again proven to be unsustainable. As in previous runs of a high market premium, a degree of normalizing has prevailed and will likely continue to prevail. The difference this time is that the normalizing remains slow, perhaps because of lingering aftershocks from pandemic-related factors.

Whatever the explanation, the spread continues to edge down. For today’s July 2024 estimate, based on monthly data, the market rate is 87 basis points above the average fair value. That’s well below the peak for this cycle (152 basis points in Oct. 2023) and the lowest since March.

The spread premium, in summary, continues to trend lower, albeit gradually and, at times, in fits and starts. Despite the recent decline, the spread still looks high relative to the historical record. But using history as a guide, it’s reasonable to expect that the still-wide difference between the market rate and the average model estimate will narrow further in the months ahead.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno