Macro Briefing: 9 September 2024

”Treasury Secretary Janet Yellen says the US economy remains strong following a string of weak job reports… Although that’s modest relative to the history, the recent increase has triggered recession warnings, according to some analysts… “The increased unemployment rate is in a range whe…

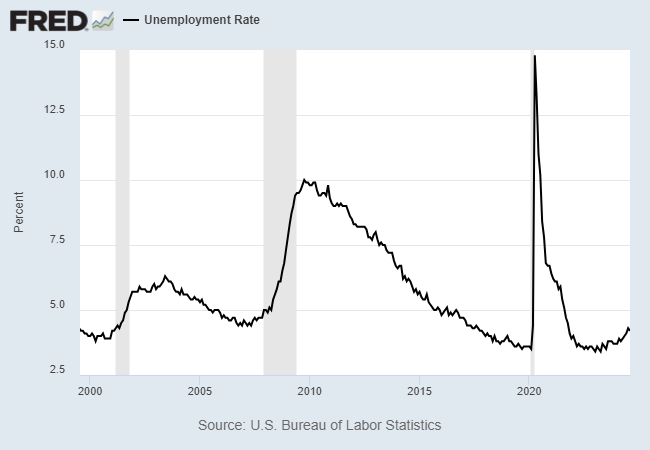

US payrolls rebounded in August, but the 142,000 increase in new jobs was less than forecast. “The labor market is cooling at a measured pace,” notes Jeffrey Roach, chief economist at LPL Financial. “Businesses are still adding to payrolls but not as indiscriminately. The Fed will likely cut by 25 basis points and reserve the right to be more aggressive in the last two meetings of the year.” The unemployment rate dipped to 4.2% from 4.3% previously. Although that’s modest relative to the history, the recent increase has triggered recession warnings, according to some analysts. “The increased unemployment rate is in a range where we have historically been in recessions,” says economist Claudia Sahm. “But that’s a history, that’s a past. We’re not in a recession right now, but we do have a weakening labor market.”

Treasury Secretary Janet Yellen says the US economy remains strong following a string of weak job reports. “We’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs,” Yellen said on Saturday. “I’m attentive to downside risk now on the employment side, but what I think we’re seeing, and hope we will continue to see, is a good, solid economy.”

China’s core inflation rate in August eased to the slowest pace in more than three years, raising that deflation risk is rising for the country. “The deflationary pressure in China is getting more entrenched,” says Michelle Lam, Greater China economist at Societe Generale. “This may well fuel a downward price-wage spiral which will require more radical policy response.”

The tech sector ex-AI is struggling, says Tony Kim, head of technology investing in BlackRock’s fundamental equities division. “When you look at technology outside of AI, there’s not that much happening. Many [sub]-sectors are still in a recession. The only thing that has been really growing has been AI.” Dustin Moskovitz, the Facebook co-founder who is now chief executive of Asana, agrees. “What we’re seeing in tech is still kind of the unwinding of the over-hiring and overspending that we saw at the beginning of the pandemic.”

The 10-year/2-year US Treasury yield curve disinverted last week, signaling elevated risk for recession, writes Interactive Brokers’ senior economist José Torres in a research note. “A positive spread across the 2- and 10-year Treasury maturities following a long period of a negative difference has historically preceded economic downturns.” Reviewing the history since 1976 indicates that an economic recession has followed every disinversion of the yield curve.

Author: James Picerno