10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 September 2024

The premium for the US 10-year Treasury yield continued to fall in August relative to the “fair value” estimate based on a model developed by CapitalSpectator… The market rate remains moderately above the model’s estimate, but as expected in previous months (see the analysis from March, for …

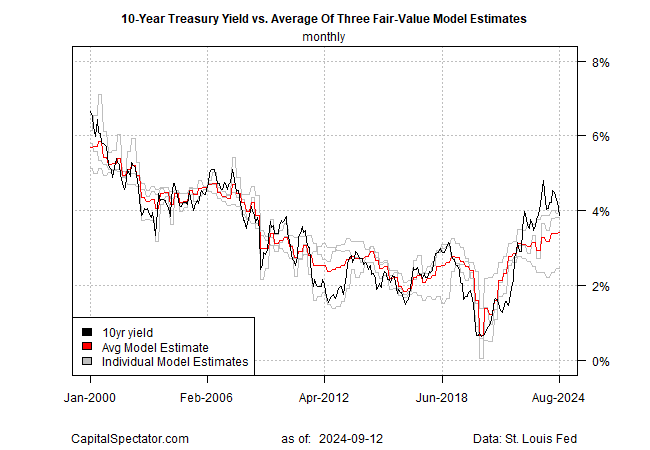

The premium for the US 10-year Treasury yield continued to fall in August relative to the “fair value” estimate based on a model developed by CapitalSpectator.com. The market rate remains moderately above the model’s estimate, but as expected in previous months (see the analysis from March, for instance) the unusually high premium is finally starting to normalize.

CapitalSpectator.com’s multi-factor fair-value model has been forecasting for some time that the relatively wide spread between the market rate and the average model estimate would narrow. History suggests that extreme deviations from the average fair-value estimate eventually return to a normal range, i.e., moderately above or below the fair-value estimate.

In recent years the deviation from fair-value has been unusually wide. At one point in late-2023, the market premium surged to 1-1/2 percentage points over the market rate – the highest in three decades. Presumably the catalyst was the shock of the pandemic-related inflation spike, which persuaded the market that inflation would remain higher for longer. But in the wake of ongoing disinflation, the 10-year yield premium has faded.

History suggests that while the particulars of each economic cycle vary, extreme yield premiums eventually normalize, even if the timing is highly uncertain. The current cycle is no different. Although the premium spike of late has been above average by a wide degree, it wasn’t unprecedented. In August, the premium fell sharply to 46 basis points, which is now modestly below the median deviation (76 basis points) since 1980.

The spread premium looks set to ease further in the coming months, although the bulk of the normalization is probably behind us. Nonetheless, the ebb and flow of the premium’s track record reminds that it’s not unusual for the premium to dip into negative terrain after an upward spike. On that basis, the modeling suggests that the 10-year yield still has room to fall. The caveat is that the confidence level for expecting further declines has eased now that the premium spike has peaked and sharply reversed.

Author: James Picerno