Macro Briefing: 7 October 2024

Has the Fed achieved a “soft landing” for the economy? The strong September jobs report offers more support for that view… “It also increases the possibility of a no-landing as well, meaning even stronger economic data for 2025 than we currently expect… US payrolls rose more than expect…

Florida braces for a direct hit from Hurricane Milton, which is expected to make landfall on Wednesday in the Tampa Bay area. The storm, with maximum sustained winds of 100 mph, is projected to move across central Florida.

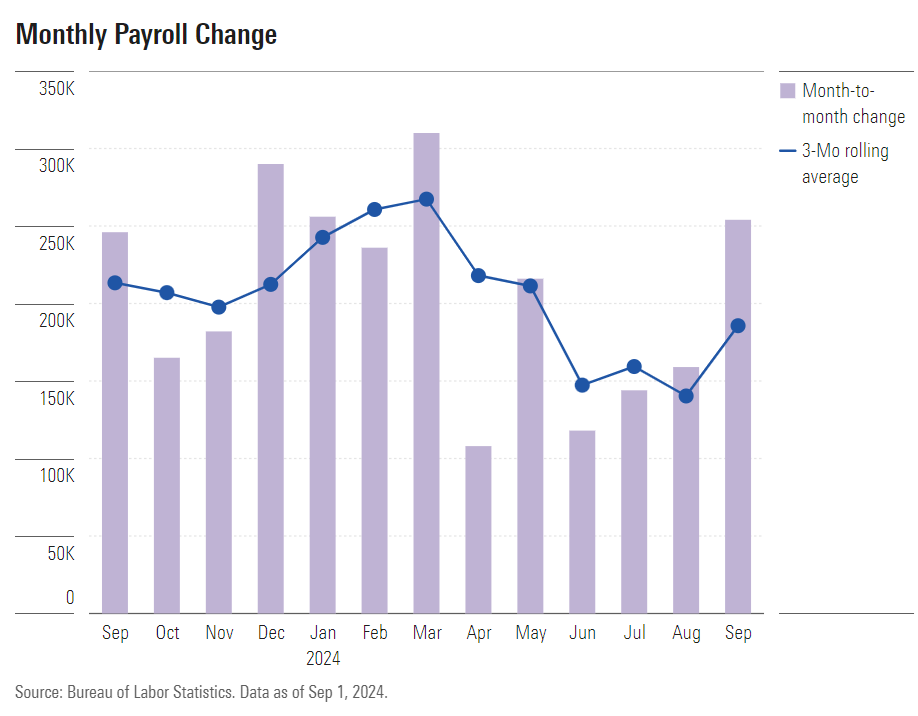

US payrolls rose more than expected in September, according to Labor Department data. The 254,000 increase beat expectations by a wide margin. The unemployment rate ticked down to 4.1%, marking the second month of lower joblessness. The government’s report also revised up previous estimates for new job creation in August and July.

Has the Fed achieved a “soft landing” for the economy? The strong September jobs report offers more support for that view. “We’ve been expecting a soft landing. This just gives us more confidence that it seems to remain in place,” says Beth Ann Bovino, chief economist at US Bank, after Friday’s better-than-expected nonfarm payrolls report. “It also increases the possibility of a no-landing as well, meaning even stronger economic data for 2025 than we currently expect.”

Fed funds futures this morning are pricing in high odds that the Federal Reserve will cut interest rates by 25 basis points at the next FOMC meeting on Nov. 7. The market’s estimate is an implied 88% probability for a 1/4-point cut vs. a 1/2-point cut last month.

Key US Treasury yields top 4% for the first time since August in the wake of a surprisingly robust increase in payrolls for September. The 10-year yield rose four basis points to 4.01%, while the two-year yield was up eight basis points to 4% in early trading today. “We’ve expected higher yields but anticipated a somewhat gradual adjustment,” Goldman Sachs Group Inc. strategists write in a note to clients. “The extent of strength in the September jobs report may have accelerated that process, with renewed debate on the extent of policy restriction, and, in turn, the likely depth of Fed cuts.”

Author: James Picerno