Macro Briefing: 16 October 2024

A Fed official says a strong labor market shouldn’t stop the central bank from cutting interest rates…” The NY Fed Manufacturing Index returns to contraction in October after a strong rise previously… The survey data also shows that “despite the weakness in general business conditions, …

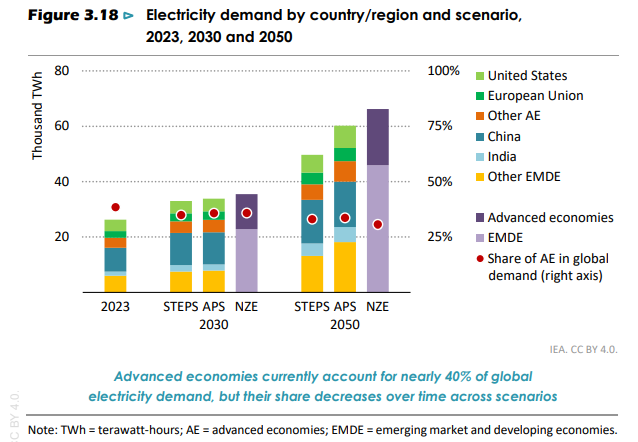

Electricity demand in the world is expected to increase much faster than overall energy demand over the next decade, predicts the IMF in the agency’s annual World Energy Outlook. Factors that are driving up demand include the rise of electric vehicles, air-conditioners and data centers.

A Fed official says a strong labor market shouldn’t stop the central bank from cutting interest rates. “I’m very opposed to cutting off expansion out of fear,” says Mary Daly, president of the Federal Reserve Bank of San Francisco. If employment growth is “a little bit faster than that [inflation], and inflation is a little bit stickier” than expected, another rate cut might prudent, she advised. “If, on the other side of that, the labor market decelerates more quickly, or inflation comes down more quickly, well, then we could make additional adjustments.”

American consumers appeared to have a solid financial footing in the third quarter, the nation’s largest banks advise. Banking executives also suggest that the US economy, if it hasn’t achieved a soft landing, is close to that state. “Consumers are broadly healthy and resilient, but more cautious,” says Citi Chief Financial Officer Mark Mason.

Economist Claudia Sahm admits her widely followed recession indicator may have been wrong this time. The so-called Sahm Rule, which analyzes the trend in US unemployment data, indicated the start of recession in July, but economic data generally continues to reflect growth. “It’s not been perfect historically,” she says of her eponymous rule. ”You go way back to the ’50s and ’60s, there were times where it turned on and turned off.” She explains: “There are so many unusual features of this labor market and of this economy, that if the Sahm rule was going to break, as with many other indicators, it would be this time.”

The NY Fed Manufacturing Index returns to contraction in October after a strong rise previously. The survey data also shows that “despite the weakness in general business conditions, optimism about the six-month outlook grew strongly.”

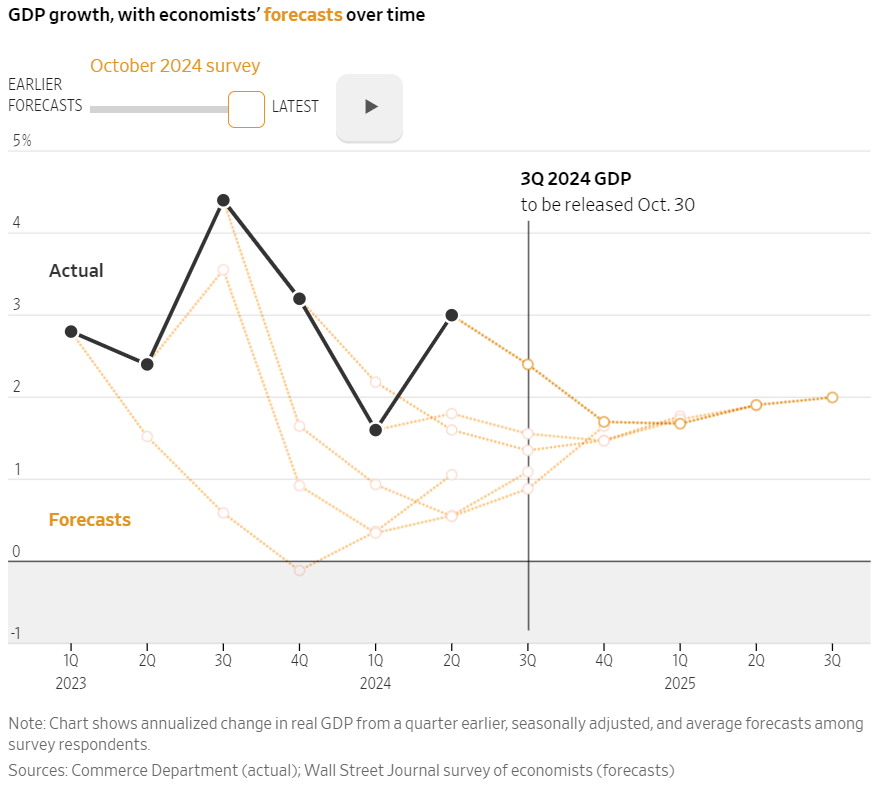

Economic forecasters are optimistic about the US economy’s outlook, according to The Wall Street Journal’s latest quarterly survey. The average forecast for the upcoming third-quarter GDP report is +2.4%. That equates with moderately softer growth vs. the +3.0 reported for Q2.

Author: James Picerno