Macro Briefing: 17 October 2024

A second Trump administration would radically change the dynamics of world trade, The Wall Street Journal reports… The former president says if elected he would implement higher trade tariffs — tariffs that may reach their highest level since the 1930s… In that case, the change would sharply r…

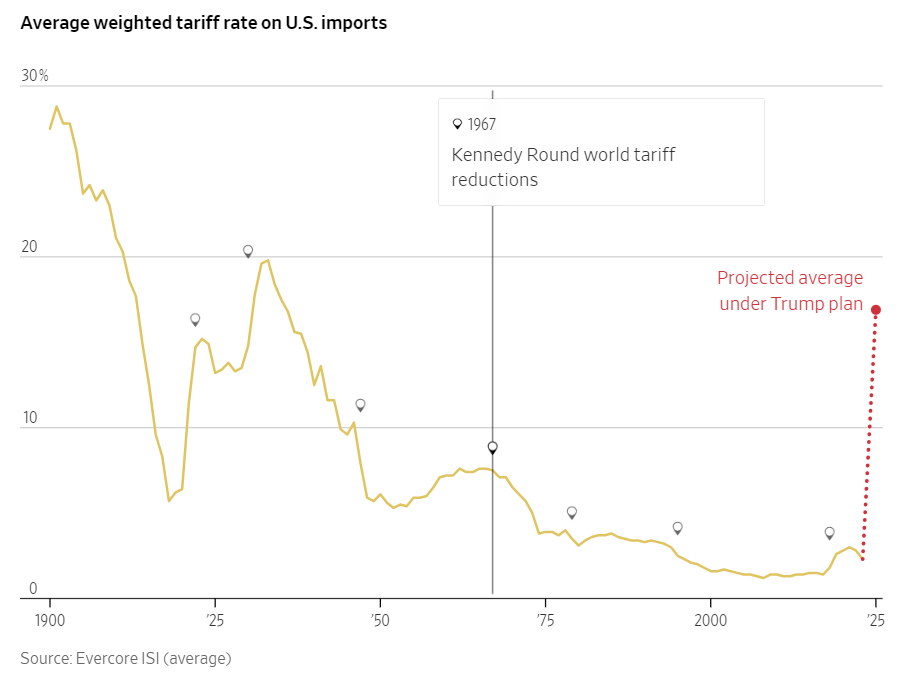

A second Trump administration would radically change the dynamics of world trade, The Wall Street Journal reports. The former president says if elected he would implement higher trade tariffs — tariffs that may reach their highest level since the 1930s. In that case, the change would sharply reverse decades of policy adjustments that favored a free-trade bias in the world economy.

US holiday sales are expected to rise by as much as 3.5% over 2023, the National Retail Federation predicts. “Overall, the economy has been in a good place this year,” says Matthew Shay, NRF’s president and CEO. “We know going into the holiday season that consumers continue to show resilience, and they show strength in their spending.”

China announces it will raise the amount of spending to support unfinished properties. Critics say that the revised figure of 4 trillion yuan ($562 billion) is still not enough to address the depth and breadth of the overbuilding of real estate in China. “It’s a ticking time bomb that will take years, maybe even decades, to defuse,” says Stephen Innes, managing partner at SPI Asset Management. “No matter how much money or effort they throw at it, this problem isn’t going away anytime soon.”

Amazon and Google are investing in nuclear power to support their growing need for energy to power AI and other business operations. “They have a desire to grow all this in a sustainable way, and at the moment the best answer is nuclear,” says Aneesh Prabhu, a managing director at S&P Global Ratings.

Cleveland Fed predicts sticky rent inflation could keep overall inflation higher for longer. The regional bank published a report on Wednesday that advises: “Our model implies that CPI rent inflation will remain above its prepandemic norm of about 3.5% until mid-2026.” If correct, rent inflation may present a stronger-than-expected challenge for the Fed in bringing overall price pressure down to its 2% target.

The US 10-year Treasury yield may be peaking after its recent runup. After topping 4.1% in recent days, marking a sharp increase from as low as 3.6% in late-September, the benchmark rate settled at 4.02% in Wednesday’s trading, the lowest close in a week.

Author: James Picerno