Macro Briefing: 18 October 2024

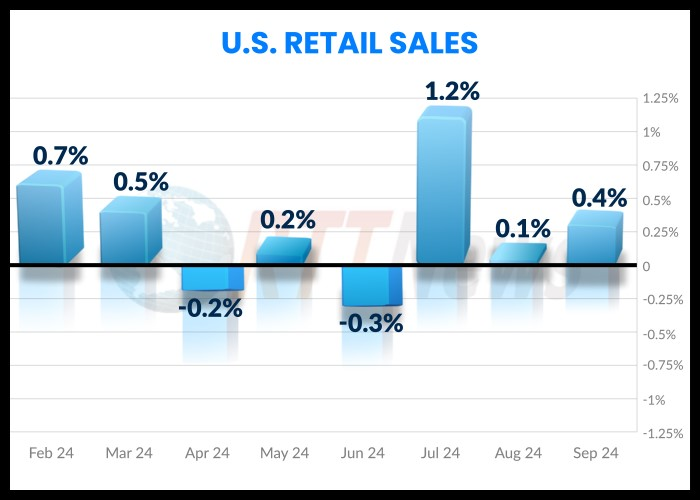

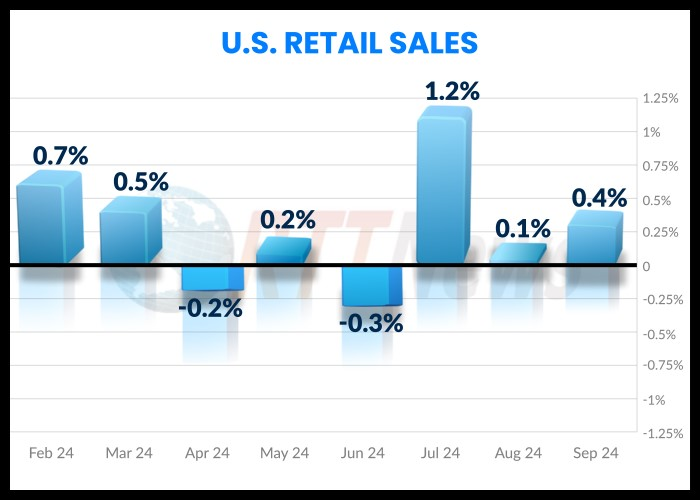

US retail sales rose for a third straight month in September, beating expectations…4% last month, marking a faster rate vs… “Strong retail spending last month suggests the recovery maintained strength through the end of the third quarter,” says FHN Financial Economic Analyst Mark Streiber……

US retail sales rose for a third straight month in September, beating expectations. Spending increased 0.4% last month, marking a faster rate vs. the tepid 0.1% rise in August. “Strong retail spending last month suggests the recovery maintained strength through the end of the third quarter,” says FHN Financial Economic Analyst Mark Streiber.

US jobless claims fell last week, returning to a range that’s prevailed in recent months. The pullback appears to be related to a normalizing adjustment following the temporary spike in the previous week due to hurricanes in the Southeast.

US industrial production fell in September. The 0.3% monthly decline was driven by a Boeing strike and two hurricanes, the Federal Reserve estimates.

The Philly Fed Manufacturing Index reflects stronger growth in October. The gain marks the second straight month of expansion for the sector, according to this survey-based index.

US home builder sentiment edged higher in October. Although the Housing Market Index still reflects a net-negative reading (below 50), this month’s print marks a second month of improvement that lifts the index to a four-month high in October, the National Association of Home Builders reports.

China’s economic growth continues to slow, based on newly released GDP data for the third quarter. On an annual basis, GDP increased 4.6% in the three months to the end of September–the softest pace since early last year.

Low US recession risk suggests the recent rise in the US stock market will continue for the near term, according to analysis by TMC Research. Reviewing market behavior during the economic expansions since 1970 remind that “the longer the expansion, the higher the stock market’s rise.” The analysis concludes: “Assuming growth will persist for an above-average period suggests the market’s current 100% rise has yet to peak… TMC Research’s models are currently estimating US recession is low and that the upcoming third-quarter GDP report will indicate moderate growth.” As a result, the case for higher stock prices remains a reasonable outlook.

Author: James Picerno