Macro Briefing: 21 October 2024

US housing starts remain subdued in September… Residential housing construction eased 0… US budget deficit tops $1… the previous year’s deficit and the third highest on record, the Treasury Department reports…8 trillion in fiscal 2024……

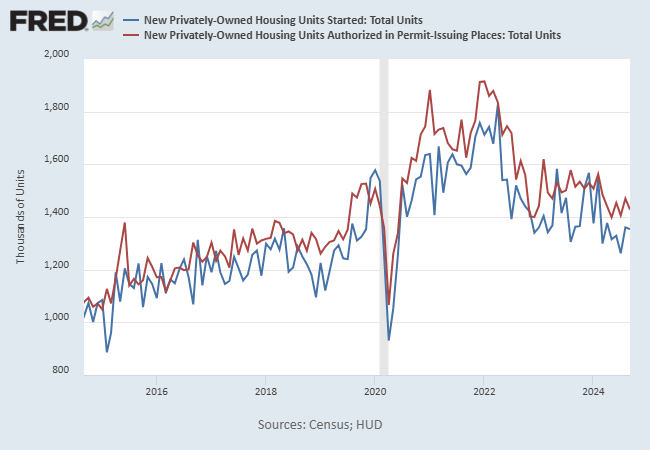

US housing starts remain subdued in September. Residential housing construction eased 0.5% to 1.35 million units last month, which is close to the lowest level since the pandemic was raging. “With affordability still a pressing issue in many regions, home building will likely remain stagnant until the Fed is well into its easing cycle and mortgage rates have fallen another one percentage point,” writes Sal Guatieri, senior economist at BMO Capital Markets, in a note.

A fragile calm for the world economy masks a variety of threats, according to the Brookings-FT Tracking Indexes for the Global Economic Recovery (Tiger). “The world economy appears calm, with falling inflation and modestly resurgent growth, but beneath the surface there is much turbulence and many simmering anxieties,” Brookings reports.

US budget deficit tops $1.8 trillion in fiscal 2024. The red ink is more than 8% higher vs. the previous year’s deficit and the third highest on record, the Treasury Department reports.

US stock market is expected to extend its rally through the end of this year, according to a Bloomberg survey. The poll of 411 questionnaire participants expects the S&P 500 Index will approach 6,000 by year-end, based on the median estimate.

Gold rose to a new record high on Friday: $2730/oz. In early trading today, the price of the metal continued to push higher. “The current market environment consists of interest rates moving south combined with heightened geopolitical risks — a scenario which suits gold on both fronts,” says Tim Waterer, chief market analyst at KCM Trade.

Author: James Picerno