Macro Briefing: 23 October 2024

Although the Fed funds futures market overall disagrees and is pricing in a cut, Sløk reasons: “The US consumer continues to do well, driven by solid job growth, strong wage growth, and high stock prices and home prices… Look at the next nonfarm payrolls report…” A surge in natural gas sup…

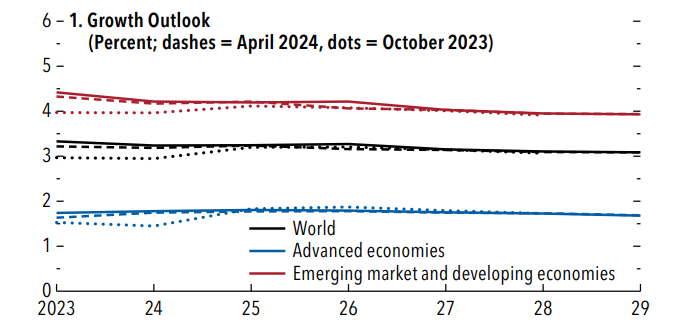

US economy will continue to provide much of the expected global growth this year and through 2025, the IMF projects. In its new World Economic Outlook report, the IMF lifted its 2024 and 2025 growth estimates for the US. The upgrade to America’s economic forecasts contrasts with flat or slightly lower estimates for other developed nations. For the world economy, “growth is expected to remain stable yet underwhelming,” the IMF reports. “At 3.2% in 2024 and 2025, the global growth projection is virtually unchanged” from this year’s April and July estimates.

The rebound in US Treasury yields is fueled by firmer expectations that the economy will continue to grow in the near term, perhaps at a faster rate than recently expected, advises Apollo chief economist Torsten Sløk. He writes in a note to clients that the Federal Reserve will “reverse course” and leave interest rates unchanged at next policy meeting on Nov. 7. Although the Fed funds futures market overall disagrees and is pricing in a cut, Sløk reasons: “The US consumer continues to do well, driven by solid job growth, strong wage growth, and high stock prices and home prices… Look at the next nonfarm payrolls report. If we do get that at 150 or 200,000, we could easily get a scenario where the Fed will basically have to reverse course and begin to stay on hold.”

A surge in natural gas supply is expected to foster an extended period of excess supply for the market, predict analysts at RBC Capital Markets. “A wave of new LNG supply —the biggest yet— is set to reshape the global market in the coming years, with broader implications than prior growth given increasing inter-linkages between regional gas markets following the Russia-Ukraine conflict.”

Money flows are rising for investments in emerging-markets funds ex-China, reports the Financial Times. The newspaper writes: “Investment firms told the Financial Times that clients increasingly see the world’s second-biggest economy [China] as too large or risky to manage alongside other developing economies such as India, leading to one of the biggest shifts in emerging markets investing in decades.”

Gold rises for a sixth straight day, closing on Tuesday at a new record high: nearly $2560 an ounce. “Gold has scaled new highs despite real and nominal yields edging higher, the dollar strengthening and U.S. equity markets scaling new highs,” advise analysts at Standard Chartered. “Gold’s ability to latch on to coat tails that take prices higher irrespective of the macro backdrop suggests that the market continues to see positive underlying flows.”

Author: James Picerno