Macro Briefing: 31 October 2024

The gain marks a slowdown from Q2’s strong 3…8% in the third quarter–a solid increase but slightly below expectations…0% increase… Personal consumption expenditures increased 3… Signed contracts to buy existing homes increase 7… Private job created rose 233,000 this month, well above …

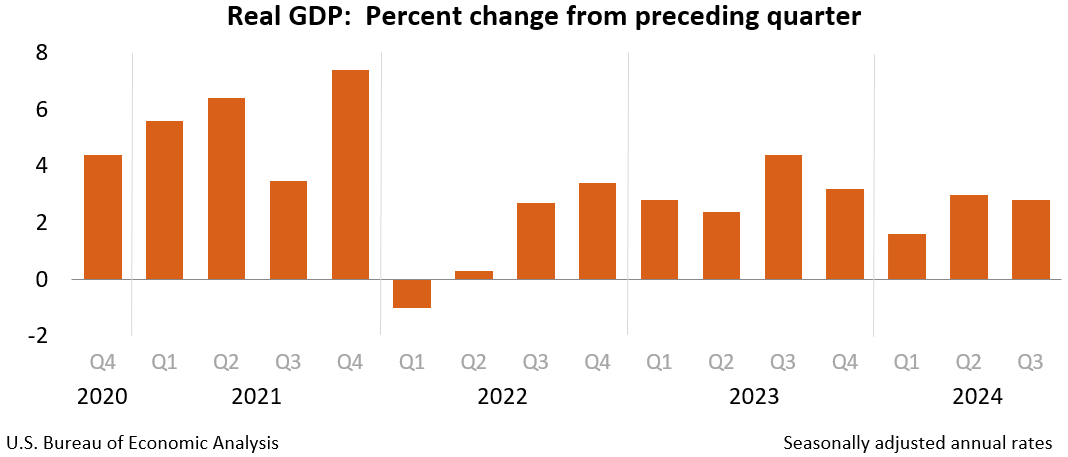

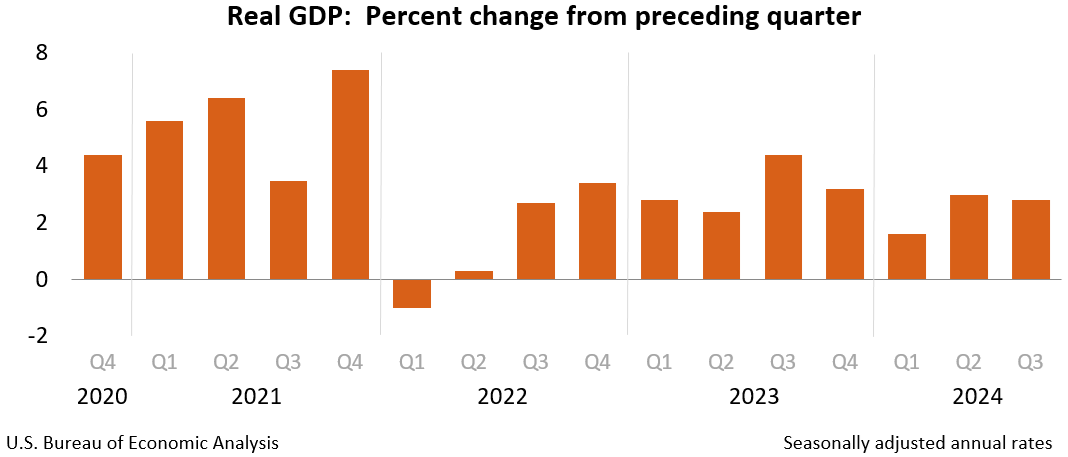

US GDP rose 2.8% in the third quarter–a solid increase but slightly below expectations. The gain marks a slowdown from Q2’s strong 3.0% increase. A key driver of Q3’s advance: higher consumer spending, which accounts for roughly two-thirds of GDP. Personal consumption expenditures increased 3.7% in Q3, a robust pickup from Q2’s 2.8%.

US pending home sales rose sharply in September, surprising analysts who expected a much softer advance. Signed contracts to buy existing homes increase 7.4% vs. the previous month, well above a projected 1% gain. “With [mortgage] rates pushing back to 7%, the rebound in pending activity is likely short lived and is unlikely to be enough to help 2024 home sales exceed 2023 levels,” forecasts Selma Hepp, chief economist at CoreLogic.

China factory activity expanded in October — the first month of growth since April, based on survey data. “I expect the economic momentum to improve moderately in Q4 as monetary and fiscal policies [loosen],” Zhiwei Zhang, president and chief economist, at Pinpoint Asset Management, said in a note.

European Union is imposing custom duties on electric vehicles imported from China after talks between Brussels and Beijing failed. The duties on Chinese manufacturers will be 17% on cars made by BYD, 18.8% on those from Geely and 35.3% for vehicles exported by China’s state-owned SAIC.

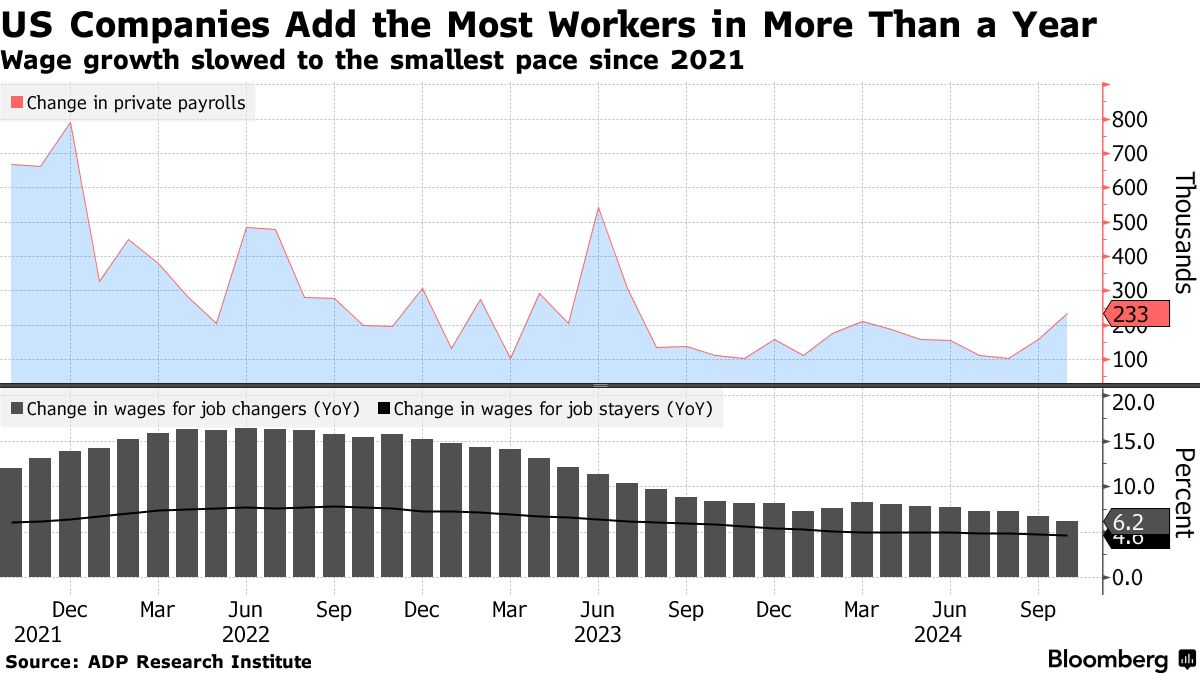

Hiring at US companies accelerated sharply in October, according to the ADP Employment Report. Private job created rose 233,000 this month, well above September’s 159,000 increase.

Author: James Picerno