Macro Briefing: 11 November 2024

Consumer inflation and retail sale data are the key US economic reports scheduled this week… “The October CPI report will likely support the notion that the last mile of inflation’s journey back to target will be the hardest,” Wells Fargo’s economics team wrote in a note to clients on F…

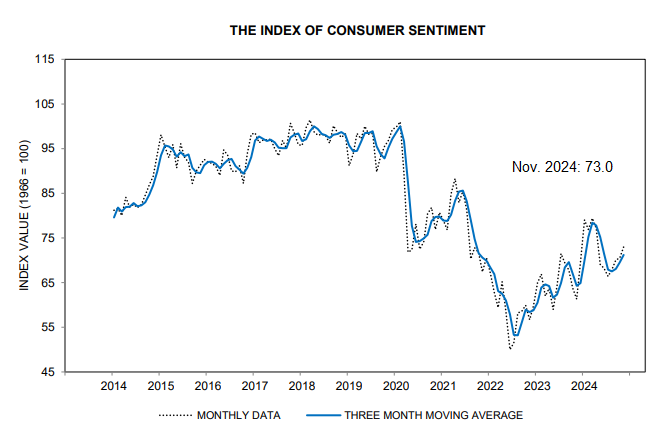

US consumer sentiment continued to improve in early November, rising for a fourth straight month to a six-month high. “While current conditions were little changed, the expectations index surged across all dimensions, reaching its highest reading since July 2021,” says Joanne Hsu, surveys of consumers director at University of Michigan, which publishes the data. The results reflect sentiment before the Nov. 5 election.

Consumer inflation and retail sale data are the key US economic reports scheduled this week. “The October CPI report will likely support the notion that the last mile of inflation’s journey back to target will be the hardest,” Wells Fargo’s economics team wrote in a note to clients on Friday. Retail spending for October is expected to rise 0.3% vs. the previous month, a tick below September’s increase, according to the consensus forecast.

Bitcoin tops $81,000 for first time on Sunday (Nov. 10). “When Bitcoin’s price goes up, people view it as more likely that it will succeed, and therefore be even more valuable. And so it’s likely to go up even further,” says Bitwise Invest CEO Hunter Horsley.

“The economic policies promised by Donald Trump, America’s president-elect, look set to turbocharge the greenback,” opines The Economist. “That spells trouble for growth in the rest of the world…. A rising dollar often comes hand in hand with a weakening global economic outlook. One reason for this is that during times of economic turmoil, investors tend to sell off their risky assets and pile into ones they perceive as safe, notably the dollar and American Treasuries.”

Extreme weather events cost global economy $2 trillion in 10 years, according to a report from Oxera for the International Chamber of Commerce for 2014-2023. The price tag is roughly equivalent to the cost of the 2008 global financial crisis. The report notes “that without enhanced climate action and mitigation efforts, the economic burden of climate-related extreme weather events will persist and likely grow.”

Trump will inherit a US that’s increasingly dominant in the global economy. America’s share of output among the Group of Seven wealthy nations is higher than at any point since at least the 1980s, according to International Monetary Fund data. “The fact that much of the rest of the world is now struggling to generate demand on its own provides more reason for countries to try to reach some sort of accommodation with Trump,” says Brad Setser, a senior fellow at the Council on Foreign Relations.

Author: James Picerno