Macro Briefing: 19 November 2024

economic hegemony, which means being the principal advocate for such policies as a strong dollar, robust economic growth, regular and predictable issuance of Treasury securities…US home builder sentiment rises for a third straight month in November, reaching the highest level since May but remain…

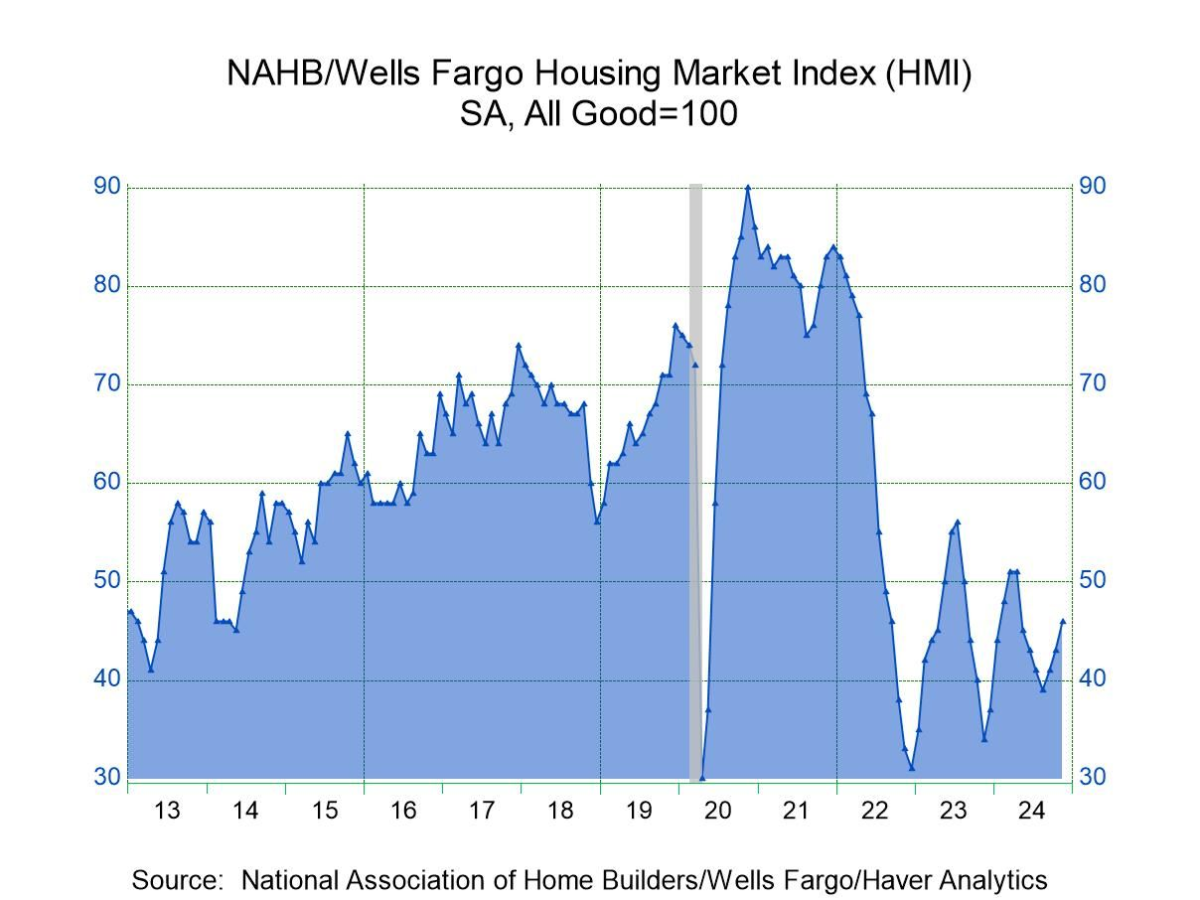

US home builder sentiment rises for a third straight month in November, reaching the highest level since May but remains below the neutral 50 mark. “With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” says Carl Harris, chairman of NAHB, which publishes the data. “This is reflected in a huge jump in builder sales expectations over the next six months.”

Russian President Vladimir Putin warned the United States on Tuesday by lowering the threshold for a nuclear strike after the Biden administration allowed Ukraine to fire American missiles deep into Russia. Moscow will consider a nuclear strike if it, or its ally Belarus, faced aggression “with the use of conventional weapons that created a critical threat to their sovereignty and (or) their territorial integrity”, the new doctrine said.

A tight US labor market continues to fan inflationary pressures, according to a new research published by the San Francisco Federal Reserve. “Declines in excess demand pushed inflation down almost three-quarters of a percentage point over the past two years,” San Francisco Fed economists Regis Barnichon and Adam Hale Shapiro write. “However, elevated demand continued to contribute 0.3 to 0.4 percentage point to inflation as of September 2024.”

Will small-cap value stocks benefit from a Trump 2.0 economy? “Small caps overall tend to be economically sensitive, but of Morningstar’s nine style box segments, small-value is the most cyclical,” writes Morningstar analyst Dan Lefkovitz. “More than 65% of the Morningstar US Small Value Index’s weight is currently in sectors like financial services, basic materials, consumer cyclicals, and real estate…. Why does the market see small-value stocks as big beneficiaries of the election results? It is clearly betting on the unleashing of what John Maynard Keynes called “animal spirits”—an infusion of economic energy. Tax cuts, deregulation, and pro-business policies are all expected from President Trump and the Republican majority in Congress.”

Will Trump’s choice for US Treasury Secretary face resistance? “Disruption can be a beautiful thing — our country was built by disrupters — but disrupter or not, Trump’s choice at Treasury should hold these principles as sacrosanct,” says Tiger Infrastructure Partners CEO Emil Henry, a former assistant Treasury secretary under President George W. Bush and a Trump donor. “The US Treasury secretary should wake up every morning focused upon driving U.S. economic hegemony, which means being the principal advocate for such policies as a strong dollar, robust economic growth, regular and predictable issuance of Treasury securities.”

BMO Capital Markets chief investment strategist expects a “normal” year for the US stock market in 2025. “It is clearly time for markets to take a somewhat of a breather,” writes Brian Belski in a research note. “Bull markets can, will and should slow their pace from time-to-time, a period of digestion that in turn only accentuates the health of the underlying secular bull. So we believe 2025 will likely [be] defined by a more normalized return environment with more balanced performance across sectors, sizes, and styles.” Belski advises that the historical record for bull markets in the third tend to generate relatively modest gains vs. the first two years.

Author: James Picerno