Desperately Seeking Yield: 19 November 2024

There’s been a lot of churning in markets recently, but there’s a conspicuously unwavering trend for the average trailing yield for the major asset classes, based on a set of ETF proxies… The yield is essentially unchanged in today’s update…Note that the current average y…

There’s little about recent history that reflects stability, with at least one exception: the average trailing payout rate on a globally diversified portfolio.

There’s been a lot of churning in markets recently, but there’s a conspicuously unwavering trend for the average trailing yield for the major asset classes, based on a set of ETF proxies.

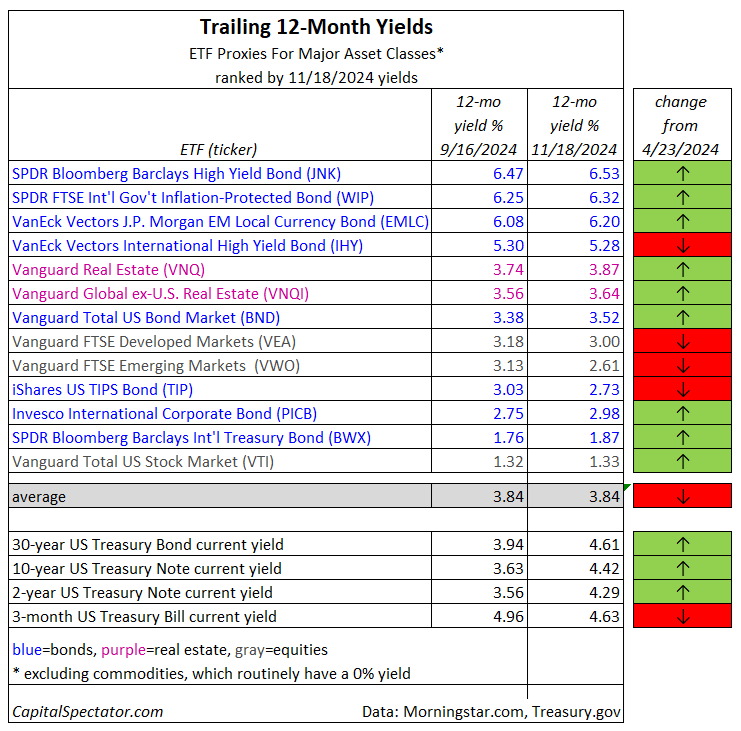

In our previous review in mid-September, the mean payout ratio for global markets was 3.84%, based on data from Morningstar.com. The yield is essentially unchanged in today’s update.

Note that the current average yield isn’t all that different from earlier in the year either. In April, for instance, the mean payout for the major asset classes was just a touch higher at 3.89%.

Echoing recent history, US junk bonds (JNK) continue to offer the highest trailing yield: 6.53%. Meanwhile, US stocks (VTI) are still the lowest with a 1.33% payout.

US Treasury yields have popped since our previous update. A 10-year Treasury yield now trades at 4.42%, a sizable jump from 3.63% in mid-September. The short end of the curve, however, has dipped: a 3-month T-bill is 4.63% vs. 4.96% previously.

Another aspect of stability that’s worth considering: the standard caveats still apply for evaluating the yields for the ETFs listed above. First, the trailing payout rates may or may not prevail in the future. Unlike the opportunity to lock in current yields via government bonds, historical payout rates for risk assets by way of ETFs can be misleading in real time, due to changing payout amounts through time.

There’s also the ever-present possibility that whatever you earn in yields via ETFs fund could be wiped out, and more, with lower share prices. That’s a reason to also consider total return expectations when evaluating yield opportunities. For perspective on ex ante performance, you can start with the monthly updates of CapitalSpectator.com’s long-term outlook for the major asset classes.

The bottom line: Chasing yield can be profitable, up to a point, but it comes with its own set of risks.

Author: James Picerno