US Continuing Jobless Claims Rise To 3-Year High. Time To Worry?

The ongoing rise in continuing claims looks worrisome, but initial claims are telling a considerably more upbeat story… Which one’s the better measure? The positive spin via initial claims is probably the superior metric for assessing the near-term outlook for payrolls and, by extension, the eco…

The ongoing rise in continuing claims looks worrisome, but initial claims are telling a considerably more upbeat story. Which one’s the better measure? The positive spin via initial claims is probably the superior metric for assessing the near-term outlook for payrolls and, by extension, the economy. But let’s dig into this view for some perspective before signing off on the idea entirely.

Every week the US Labor Department publishes a pair of timely reads on the state of layoffs. Most of the attention is on initial jobless claims, which are widely viewed as valuable leading indicator for payrolls and the economy overall. The continuing claims data set draws less attention, in part because the numbers aren’t considered a leading indicator. Continuing claims are also published on a slightly less timely basis – one week behind initial data.

Continuing claims, in sum, carry less weight for looking forward. At the moment, initial claims are diverging on the downside vs. the rising continuing data and so it’s reasonable to assume that the labor market outlook is brighter than conveyed by continuing figures.

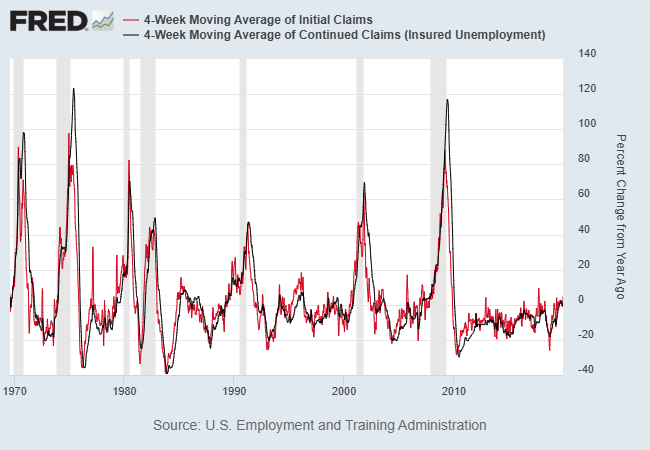

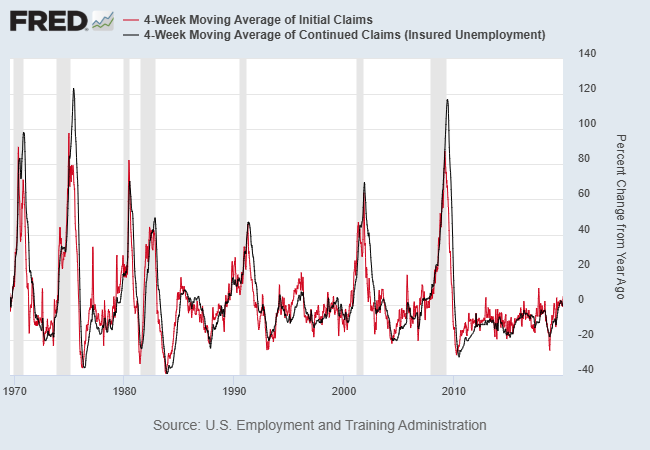

For some context, consider the year-over-year change in initial and continuing claims via their 4-week moving averages. This transformation reduces a lot of the noise that can blur the week-to-week changes. Here’s how the decades unfolded prior to the extreme volatility unleashed by the pandemic shock. The main takeaway: initial and continuing claims tend to rise together — ahead of, and in the early stages of, recessions.

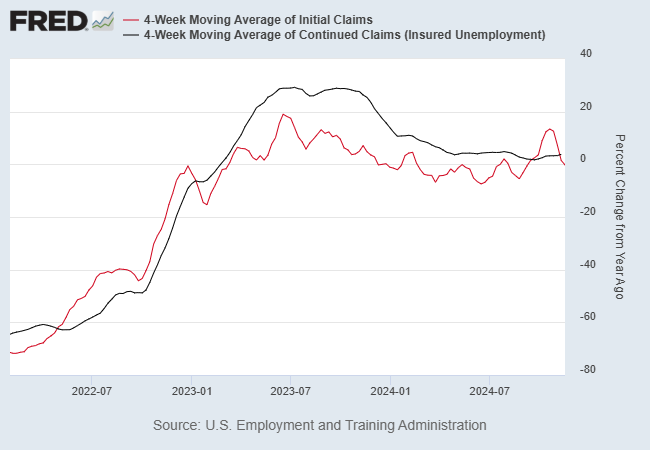

Now let’s focus on recent history since early 2021. The runup for both data sets through early 2023 has since peaked. As we now know, the jump in initial jobless claims during that period highlighted a slowdown in economic activity, but the downshift wasn’t enough to push the economy into a recession. Note that it took continuing claims a bit longer to confirm that it was a soft patch (and not a recession) vs. the somewhat more timely confirmation via initial claims.

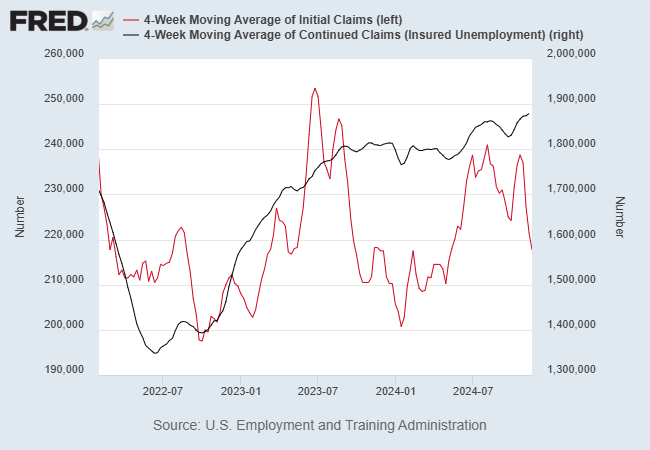

The question in recent weeks is whether the recent rise in continuing claims is a new warning for the labor market and the economy? Initial claims suggest otherwise, based on the latest downturn in new filings for unemployment benefits, which continued to fall last week, as shown the next chart below, which reflects the latest data.

The divergence between continuing and initial claims isn’t unprecedented over short-term periods. Eventually, one or the other will confirm the trend. For the moment, initial claims carry more weight for assessing the outlook, primarily based on history.

But let’s be clear: We may be in a transition phase for the labor market, as discussed yesterday. It’s all speculation at this point and so dark forecasts should be viewed cautiously.

Meanwhile, keep a close eye on the diverging trends in continuing vs. initial claims. This gap will probably close soon, in favor of the relatively upbeat claims data.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno