Macro Briefing: 2 December 2024

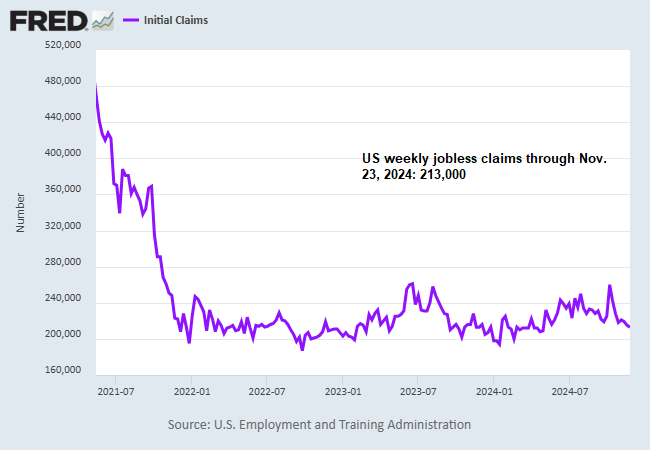

US jobless claims fell for a third straight week, slipping to a 7-month low… “The underlying trend in first-time claims implies that firms continue to carefully manage their workforce amid an economy at full employment,” writes Joseph Brusuelas, chief economist at RSM US… The recent decline …

US jobless claims fell for a third straight week, slipping to a 7-month low. The recent decline and relatively low level of new filings for unemployment benefits suggest that the labor market will remain resilient in the near term. “The underlying trend in first-time claims implies that firms continue to carefully manage their workforce amid an economy at full employment,” writes Joseph Brusuelas, chief economist at RSM US.

Pending home sales in the US increased 2.0% in October. “Homebuying momentum is building after nearly two years of suppressed home sales,” says the chief economist of the National Association of Realtors. “Even with mortgage rates modestly rising despite the Federal Reserve’s decision to cut the short-term interbank lending rate in September, continuous job additions and more housing inventory are bringing more consumers to the market.”

China’s November factory growth hits five-month high in November via PMI survey data. “Central to the latest advancement in manufacturing sector conditions was greater new business inflows,” says Caixin Insight Group’s senior economist Wang Zhe.

Eurozone manufacturing activity falls into a deeper slump in November, based on PMI survey data. “The downturn is widespread, hitting all of the top three eurozone countries. Germany and France are faring the worst, and Italy is not doing much better,” says Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank.

US GDP growth for the third remained at 2.8% for the revised data, the government reports. The update continues to show a slight downshift from Q3’s 3.0% increase.

US durable goods orders rose less than expected in October. The 0.2% rise, however, marks the first monthly increase since July’s dramatic advance.

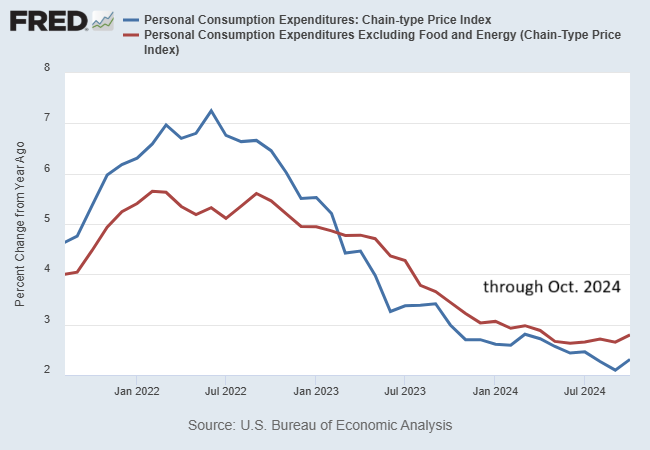

Fed’s preferred inflation indicator — personal consumption expenditures price index — picked up to a 2.3% year-over-year rate in October, above September’s 2.1% rise. Core PCE inflation continued to rise at a faster pace, advance 2.8% through October, the highest since April. Both measures remain above the Fed’s 2% inflation target.

Author: James Picerno