Major Asset Classes | November 2024 | Performance Review

Global markets delivered mixed results in November… Commodities and shares in emerging markets suffered the biggest losses in November…7% surge in US equites (VTI), marking the strongest gain for the major asset classes in November… US bonds (BND) in November recovered some of their losses fro…

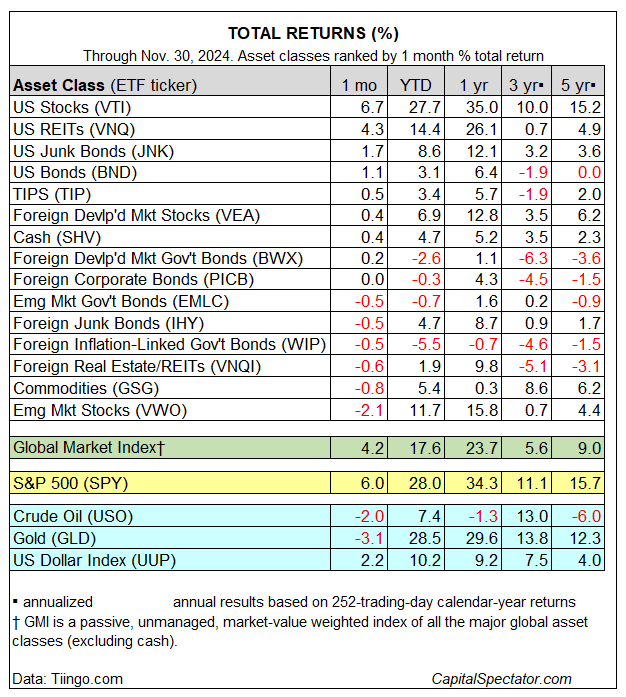

Global markets delivered mixed results in November. US stocks and real estate estate investment trusts led last month’s winners, rebounding with solid gains following October’s decline, based on a set of ETFs. Commodities and shares in emerging markets suffered the biggest losses in November.

The crowing performer last month: a 6.7% surge in US equites (VTI), marking the strongest gain for the major asset classes in November. For the year so far, American shares are up nearly 28%, leading the field by a wide margin in 2024.

US bonds (BND) in November recovered some of their losses from October, rallying 1.1%. US junk bonds (JNK), however, continued to steal the thunder for fixed income and rose 1.7% last month, recovering all of October’s loss and more.

November’s biggest loser: emerging markets stocks (VWO), which shed 2.1%. The decline marks the second monthly loss following eight straight monthly gains.

The Global Market Index (GMI) rebounded sharply in November, jumping 4.2%, which more than reversed October’s slide. GMI has rallied in nine of 11 months so far in 2024 and is currently higher by a strong 17.6% year to date. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

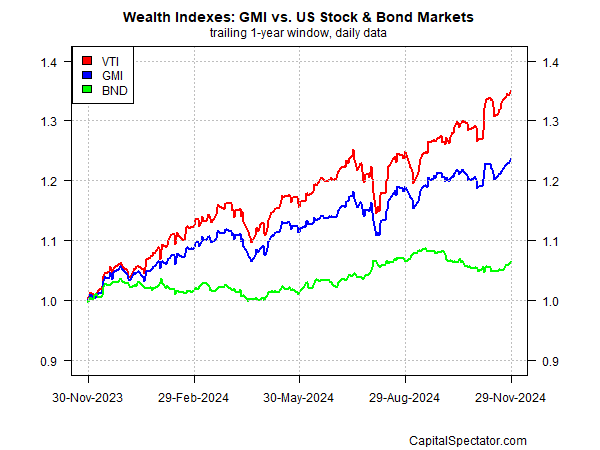

For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND).

Author: James Picerno