Macro Briefing: 5 December 2024

Hiring activity was subdued as worker turnover remained low and few firms reported increasing their headcount,” reports the so-called Beige Book…2% fall in September, reports the Commerce Department’s Census Bureau… “The upturn remained largely driven by the services sector, as the perfor…

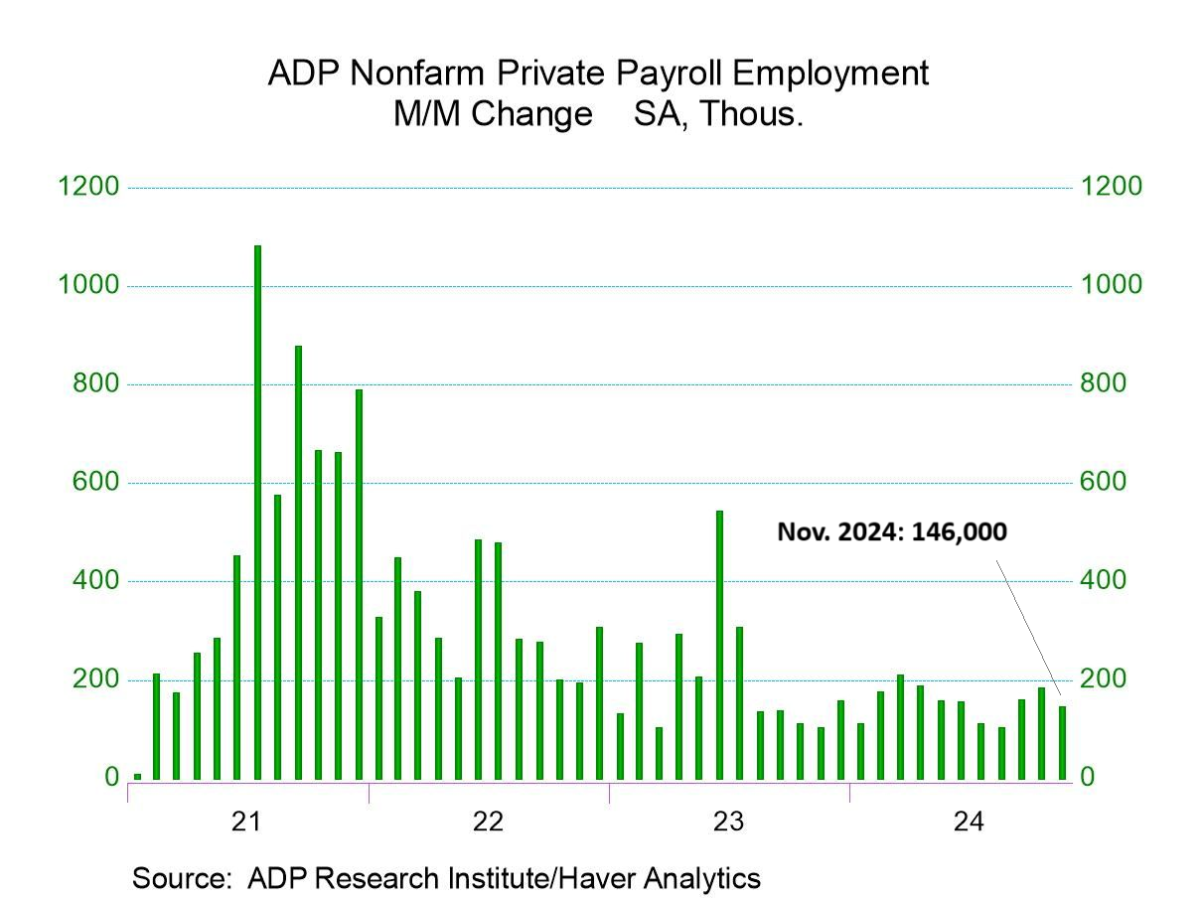

US nonfarm private sector payrolls rose 146,000 in November, down from a 184,000 gain in the previous month, according to the ADP Employment Report. “While overall growth for the month was healthy, industry performance was mixed,” says Nela Richardson, chief economist at ADP. “Manufacturing was the weakest we’ve seen since spring. Financial services and leisure and hospitality were also soft.”

The US expanded steadily in November, but hiring was subdued and inflation was still a problem in some parts of the economy, a new Federal Reserve survey found. “Employment levels were flat or up only slightly across Districts. Hiring activity was subdued as worker turnover remained low and few firms reported increasing their headcount,” reports the so-called Beige Book.

The US services sector posted slower growth in November vs. the previous month, according to the ISM Services Index. The survey-based index slipped to 52.1, a moderate downshift from October’s 56.0 reading. The update indicates that the sector posted an expansion (above 50) for a fifth straight month.

New orders for US-manufactured goods rebounded modestly in October while business spending on equipment shows signs of softening at the start of the fourth quarter. Factory orders increased 0.2% after a revised 0.2% fall in September, reports the Commerce Department’s Census Bureau.

Global economic growth edged higher in November, according to the JP Morgan Global Composite PMI. This survey-based index ticked up to 52.4 from 52.3 in October. A reading above 50 indicates growth. “The upturn remained largely driven by the services sector, as the performance of the goods-producing industry was comparatively lackluster,” the report notes.

Bitcoin traded at $100,000 for the first time. The rise is reportedly fueled by driven by expectations that President-elect Donald Trump’s administration will create a crypto-friendly regulatory environment in the US.

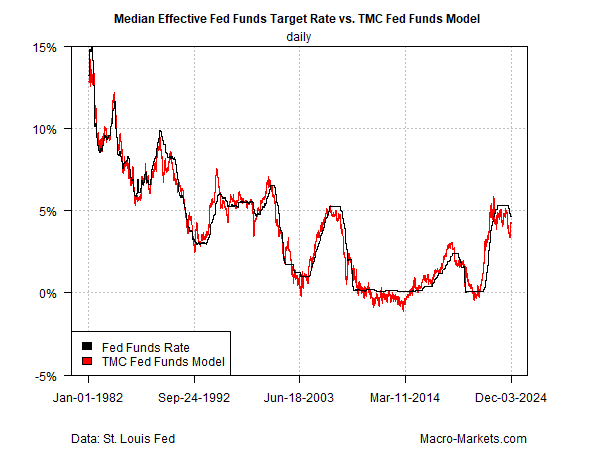

The case for another rate cut this month is fading, according to TMC Research’s Fed funds model. The revised estimate of the optimal Fed funds rate ” suggests it may be prudent to leave policy unchanged at the Dec. 18 FOMC meeting.” Meanwhile, “The economy is still humming and there’s a possibility that inflation and/or the real economy could heat up in early 2025. Additional stimulus, in other words, isn’t a pressing issue at the moment.”

Author: James Picerno