Momentum, Large-Cap Growth Set To Top Factors Returns In 2024

That sums up the horse race for much of this year based on a set of ETFs targeting the main US equity factor risk premiums… Going in to the home stretch for 2024, the momentum and large-cap growth factors continue to post a commanding lead over the rest of the field, based on trading through Wedn…

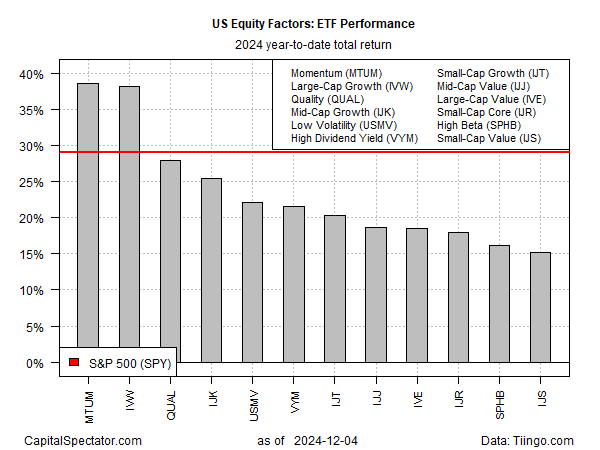

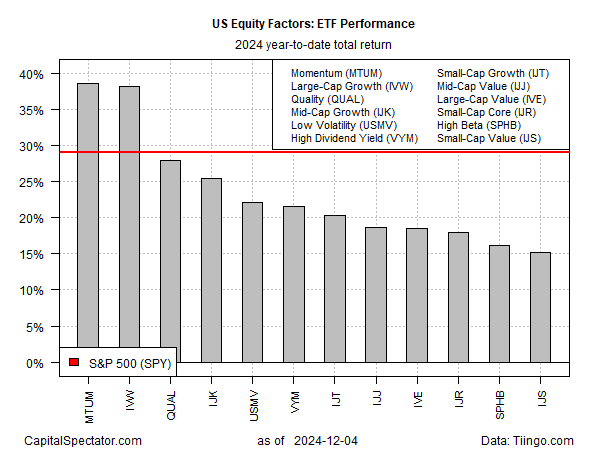

The winners keep on winning. That sums up the horse race for much of this year based on a set of ETFs targeting the main US equity factor risk premiums. Going in to the home stretch for 2024, the momentum and large-cap growth factors continue to post a commanding lead over the rest of the field, based on trading through Wednesday’s close (Dec. 4).

In first place is momentum (MTUM) via a sizzling 38.7% year-to-date total return. Virtually tied for the top spot is the second-place large-cap-growth factor (IVW) with a 38.2% rise so far in 2024. If you’re wondering why a particular active manager focused on US equities is doing well this year, allocations to one or both of these factors probably explains a lot.

Both funds are well ahead of other factors and for the stock market overall, based on SPDR S&P 500 ETF (SPY), which is ahead by 29.1% year to date.

Notably, all the factor ETFs in the chart above are posting gains this year. That’s a sign that this year’s market rally is broadly based. Nonetheless, there’s a wide gap between the highest and lowest performers. Small-cap value stocks (IJS) are higher by 15.2% in 2024, the weakest factor.

Will the last become the first in 2025? That’s the hope (again) in some circles. Contrarians argue that the lagging performances in the small-cap sector lay the groundwork for stronger results in the year ahead. Optimists favoring this narrative can point to the fact that over the past month small-cap growth, value and core ETFs have outperformed momentum and large-cap growth.

Is this the opening bid in a small-cap recovery for 2025? That’s the argument that some investors are predicting. They may be right this time. Skeptics will argue that we’ve been here before. But the allure of “this time is different” renews hope that an enduring rebound may finally be at hand.

Among the catalysts cited in favor of predicting that the small-cap rally will persist: the coming change in US policy once the incoming Trump administration takes power next month.

“Small-capitalization stocks are having their moment in the sun as part of the ‘Trump trade,’” writes a Wall Street Journal columnist today. “Whether they end up having staying power might have little to do with tariffs.” The reasoning:

Catalysts for a more lasting shift are accumulating. The Republican Party’s sweep appears to herald lower taxes, lighter financial regulations and higher tariffs, which Wall Street believes will benefit domestically oriented businesses more than multinationals.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno