Risk-On Sentiment Prevails For 2025’s Debut, Fueled By US Stocks

Following a modest correction last summer, the ratio for an aggressive mix of global assets (AOA) vs…The risk appetite for US equities continues to rebound after the summer’s sharp correction, based on the ratio for a broad equities ETF (SPY) vs… In recent weeks, the American pre…

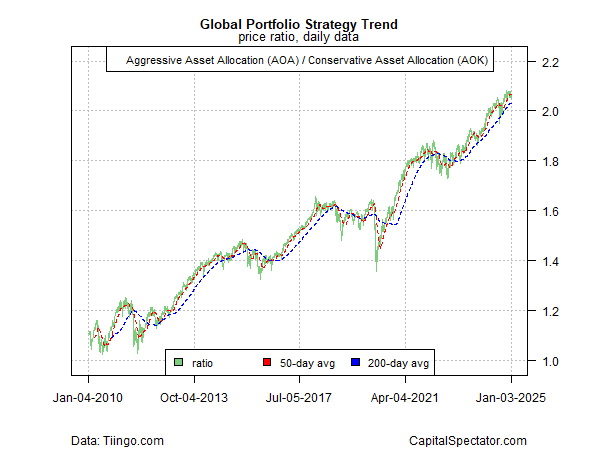

There are many reasons to question a bullish outlook at the start of the year, but the gravity-defying trend remains intact overall, based on a set of ETF pairs that track global asset allocation strategies through Friday’s close (Jan. 3). The analysis turns mixed, however, when analyzing markets on a more granular level.

From a global top-down perspective, the bullish trend still looks solid. Following a modest correction last summer, the ratio for an aggressive mix of global assets (AOA) vs. a conservative counterpart (AOK) continues to trend higher.

The risk appetite for US equities continues to rebound after the summer’s sharp correction, based on the ratio for a broad equities ETF (SPY) vs. a low-volatility portfolio of stocks (USMV).

The caveat: the bullish momentum for equities is increasingly reliant on US shares — stocks ex-US, by comparison, are faltering. Consider, for instance, the bull run in US shares (VTI) relative to stocks in developed markets ex-US (VEA). In recent weeks, the American premium for equities has surged, a trend that’s become extreme lately, as shown by the VTI:VEA ratio.

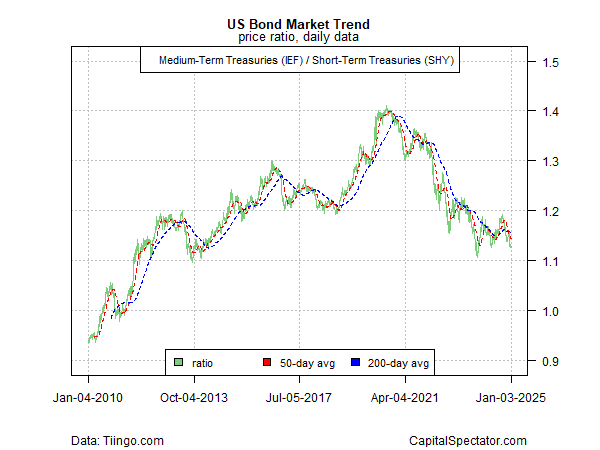

For US bonds, a risk-off trend persists, based on the ratio for medium-term Treasuries (IEF) vs. short-term maturities (SHY). Despite several attempts to recover in recent years, the downside bias has resumed.

The sharp divergence in US stocks (SPY) vs. US bonds overall (BND) tells a similar story: risk-on for equities dominates as fixed-income beta slumps.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno