Macro Briefing: 15 January 2025

3% year-over-year level through December…9 billion, roughly $200 billion over the prior-year period… Policy-sensitive US 2-year Treasury yield trades at/near highest level since late-November ahead of today’s consumer inflation data for December…US producer price inflation increased to a 3…..

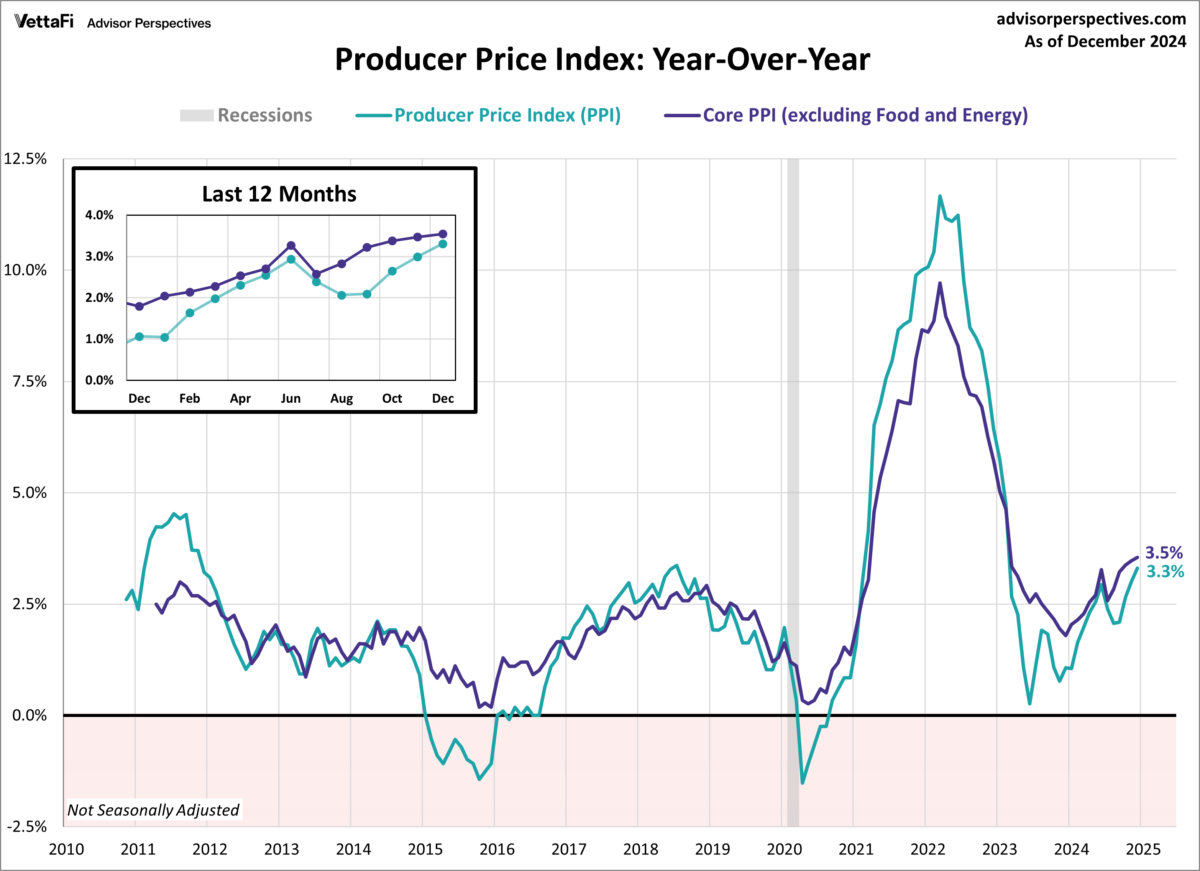

US producer price inflation increased to a 3.3% year-over-year level through December. Although that’s below expectations, it’s also the fastest pace since Feb. 2023. “Better than expected is not necessarily what the Fed wants to see before easing monetary conditions into a fast-growing economy, with tariffs and tax cuts on the agenda of the incoming administration,” says Carl Weinberg, chief U.S. economist at High Frequency Economics.

The US federal budget deficit deepened in December, increasing the amount red ink in the fiscal quarter by 40% vs. the year-ago level. The three-month fiscal year total deficit tis $710.9 billion, roughly $200 billion over the prior-year period.

Germany’s economy contracts for second straight year in 2024. Output fell 0.2% last year, in line with expectations. The president of the German statistics agency, Destatis, says that “cyclical and structural pressures” weighed on economic activity. “These include increasing competition for the German export industry on key sales markets, high energy costs, an interest rate level that remains high, and an uncertain economic outlook.”

S&P 500 Equal Weight exchange traded fund (RSP) attracts record inflows in second half of 2024. Analysts say it reflects investor concerns on the sharp rally in the largest stocks in the S&P 500, namely, the so-called Magnificent Seven tech stocks — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. “Investors’ biggest focus recently has been concentration risk, worries that the market is too top-heavy,” says Manish Kabra, head of US equity strategy at Société Générale.

Policy-sensitive US 2-year Treasury yield trades at/near highest level since late-November ahead of today’s consumer inflation data for December. Meanwhile, Fed funds futures continue to price in high odds that the central bank will leave interest rates unchanged at the upcoming Jan. 29 policy meeting.

Author: James Picerno