Macro Briefing: 10 March 2025

The economy added 151,000 jobs last month, up from 125,000 in the previous month… “Despite elevated levels of uncertainty, the US economy continues to be in a good place,” he said on Friday… “Just a couple of weeks ago we were getting questions about whether we think the US economy’s re…

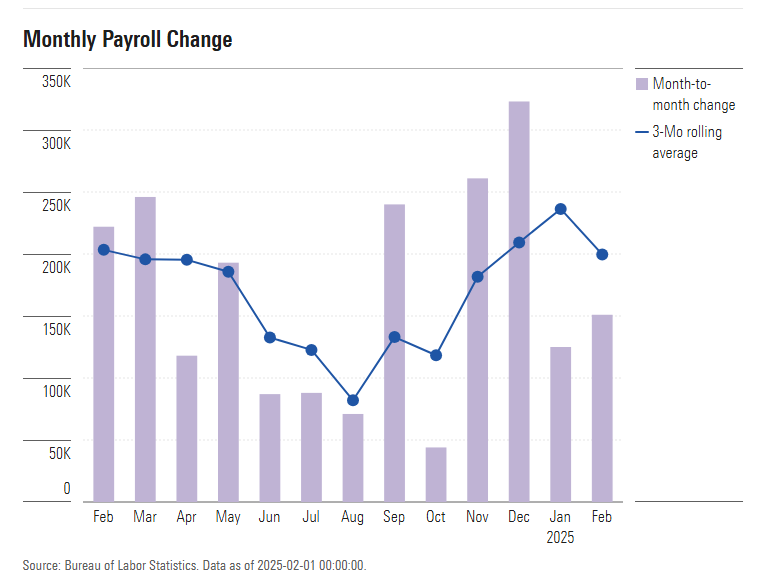

US nonfarm payrolls picked up in February, rising moderately vs. the number of hirings in January. The economy added 151,000 jobs last month, up from 125,000 in the previous month. “Job growth is holding steady, but headwinds are building,” says Morningstar senior US economist Preston Caldwell. The government’s surveys have “likely yet to register more than a sliver of the full impact from federal government layoff. That should change in next month’s job report.”

Trump won’t rule out the possibility of recession in 2025. Asked about the potential for an economic downturn at some point this year, the president said: “I hate to predict things like that,” in an interview. “There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing.”

Economists say that the risk of recession has increased for the US, Canada and Mexico due to uncertainty created by a chaotic implementation of tariffs by the White House. A Reuters poll last week found 91% of economists view the odds of a downturn to have increased under Trump’s rapidly shifting trade policies.

China’s consumer prices turned negative for the first time in 13 months in February. The CPI declined by 0.7% last month from a year earlier, data published Sunday by China’s National Bureau of Statistics showed, reversing a year-on-year gain of 0.5% in January.

US inflation expected to remain sticky in Wednesday’s update of consumer prices for February. “Chair Jerome Powell has said the Fed needs to see ‘real progress’ on inflation or some labor-market weakness to consider adjusting rates again,” advised Bloomberg Economics. “After early-year price resets stalled disinflation in January, policymakers will be looking for new progress in February’s CPI. We expect only modest improvement as residual seasonality effects linger: We estimate both headline and core CPI inflation rose 0.3%.”

Fed Chairman Powell said he’s not worried about the US economic outlook. “Despite elevated levels of uncertainty, the US economy continues to be in a good place,” he said on Friday. “Sentiment readings have not been a good predictor of consumption growth in recent years.”

The recent decline in Treasury yields reflects the bond market’s forecast of higher odds for softer economic growth, according to some analysts. “Just a couple of weeks ago we were getting questions about whether we think the US economy’s re-accelerating —- and now all of a sudden the R word is being brought up repeatedly,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities, referring to recession risk. “The market’s gone from exuberance about growth to absolute despair.”

Author: James Picerno