Looking For Safe Havens During A Stock Market Correction

The US stock market fell on Thursday, Mar… A “bear market,” according to Wall Street-speak, arrives when a decline exceeds 20%… Yet some corners of global markets are holding up if not rallying… “Amid escalating geopolitical tensions, rising trade tariffs, and growing financial market un…

The US stock market fell on Thursday, Mar. 13, closing 10.1% below its previous peak – a decline that many analysts define as a “correction,” which is a slide ranging from 10% to 20%. A “bear market,” according to Wall Street-speak, arrives when a decline exceeds 20%. The “B” word doesn’t apply, at least not yet, but stocks are clearly on the defensive. Yet some corners of global markets are holding up if not rallying. Here’s a quick review that highlights a select list of recent winners, based on a set of ETFs through yesterday’s close.

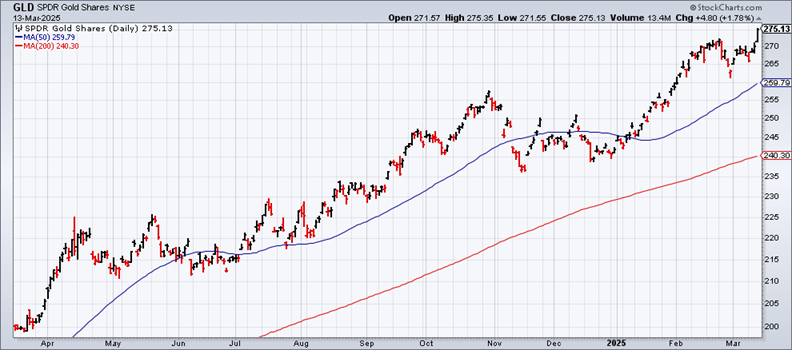

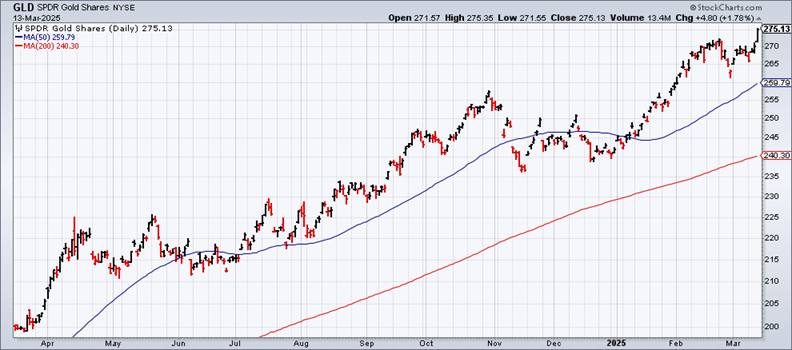

A leading bright spot at the moment is gold (GLD), which continues to rally; the metal set a new record high yesterday. “Amid escalating geopolitical tensions, rising trade tariffs, and growing financial market uncertainty, investors are increasingly seeking stability – and they are finding it in gold,” said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany.

Short-term US Treasuries are also resilient in the current climate. The iShares 1-3 Year Treasury Bond ETF (SHY) closed up yesterday, trading near a record high.

Certain portfolio strategies are also looking strong this year. One bullish standout is merger arbitrage. The recent uptrend for the IQ Merger Arbitrage ETF (MNA) has been a port in a storm this year.

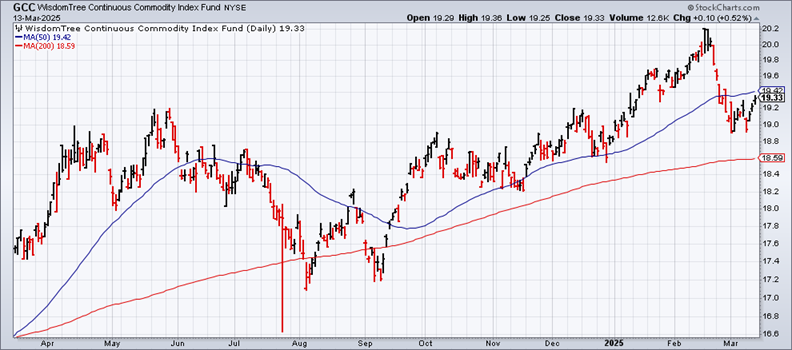

Some versions of broadly defined commodities portfolio are also posting relative strength in 2025. The WisdomTree Commodity Index (GCC) is up 2.7% year to date despite a recent setback.

Prices for foreign government bonds have been rising lately from a US-investor perspective, in part due to a weak US dollar this year. When the greenback falls, that’s usually a tailwind for foreign assets denominated in foreign currencies. The bullish effect is conspicuous in government bonds issued in developed markets ex-US (BWX).

Government bonds issued in emerging markets (EMLC) are posting even stronger results in 2025.

Back in the US, stocks in the utilities sector (XLU) have traditionally been a safe haven and there’s some evidence for maintaining that view amid the latest correction for stocks overall. Utilities have been relatively stable this year and are currently posting a 2.2% advance for 2025 through yesterday’s close.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno