Macro Briefing: 21 April 2025

The stakes include capital flows into the US, which some analysts predict could slow, depending on how trade rules evolve… “This idea that you can break trade, and not break the capital flow side, is a fantasy,” said Steven Blitz, chief U… Bank of America’s regular monthly survey of insti…

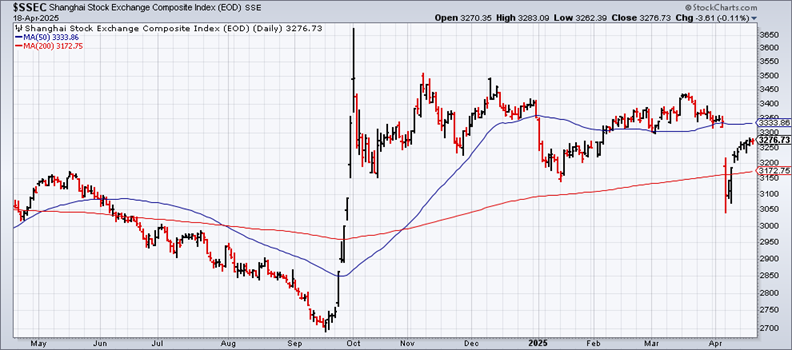

China warns countries it will retaliate if governments engage in agreements with the US that threaten Beijing’s interests. “Appeasement cannot bring peace, and compromise cannot earn one respect,” a Chinese Commerce Ministry spokesperson said. “China firmly opposes any party reaching a deal at the expense of China’s interests. If this happens, China will never accept it and will resolutely take countermeasures.” On Friday, China’s Shanghia Stock Exchange Composite Index closed at a roughly middling level relative to recent history.

The initial impact of US tariffs for the world economy are expected to show up in new economic projections from the IMF scheduled for release on Tuesday. “Our new growth projections will include notable markdowns, but not recession,” IMF Managing Director Kristalina Georgieva said last week. “We will also see markups to the inflation forecasts for some countries. We will caution that protracted high uncertainty raises the risk of financial-market stress.”

Financial markets this week will continue to weigh risks posed by a radical shift in US trade policy. The stakes include capital flows into the US, which some analysts predict could slow, depending on how trade rules evolve. “This idea that you can break trade, and not break the capital flow side, is a fantasy,” said Steven Blitz, chief U.S. economist at GlobalData TS Lombard.

Republican Sen. John Kennedy of Louisiana said Trump is unlikely to fire Federal Reserve Chairman Powell. Following Trump’s attacks on the Fed chairman last week, Sen. Kennedy said on Sunday: “I don’t think the president, any president, has the right to remove the Federal Reserve chairman. I think the Federal Reserve ought to be independent.”

The mood among fund managers has turned bearish — quickly. Bank of America’s regular monthly survey of institutional investors, released last week, shows a sharp rise in expectations for a “hard landing” for the US economic outlook.

Author: James Picerno