Macro Briefing: 23 April 2025

“Intensifying downside risks dominate the outlook, amid escalating trade tensions and financial market adjustments,” the IMF advised in its revised World Economic Outlook… Ratcheting up a trade war and heightened trade policy uncertainty may further hinder both short-term and long-term growth…

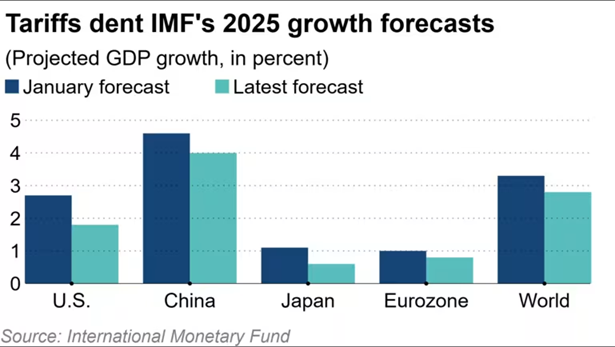

The IMF cut its global growth outlook for 2025, citing tariffs as a factor. US output is expected to downshift to a 1.8% increase this year, nine-tenths of a percentage point below the previous forecast in January. “Intensifying downside risks dominate the outlook, amid escalating trade tensions and financial market adjustments,” the IMF advised in its revised World Economic Outlook. “Divergent and swiftly changing policy positions or deteriorating sentiment could lead to even tighter global financial conditions. Ratcheting up a trade war and heightened trade policy uncertainty may further hinder both short-term and long-term growth prospects. Scaling back international cooperation could jeopardize progress toward a more resilient global economy.”

Trump says he has no plans to fire Federal Reserve Chairman Powell. “I have no intention of firing” Powell, he told reporters on Tuesday, just days after writing on social media that “Powell’s termination cannot come fast enough.”

Treasury Secretary Bessent predicts tax cuts will pass by July 4. Speaking at a private JP Morgan investor event on Tuesday, he discussed his outlook for President Trump’s economic agenda for the rest of the year.

President Trump suggests a softening of his trade war with China may be near. The high tariffs on Chinese goods will “come down substantially, but it won’t be zero,” he said at a White House event on Tuesday.

The Trump administration is reviewing 18 trade proposals as President Trump’s trade team is meeting with 34 countries this week, White House Press Secretary Karoline Leavitt said on Tuesday. She added that the administration is “setting the stage for a deal” with China.

Fed funds futures continue to price in a high probability (90%-plus) that the Federal Reserve will leave its target interest rate unchange at the next FOMC meeting on May 7.

Author: James Picerno