Macro Briefing: 24 April 2025

“The early flash PMI data for April point to a marked slowing of business activity growth at the start of the second quarter, accompanied by a slump in optimism about the outlook,” said Chris Williamson, chief business economist at S&P Global Market Intelligence, which published the report….

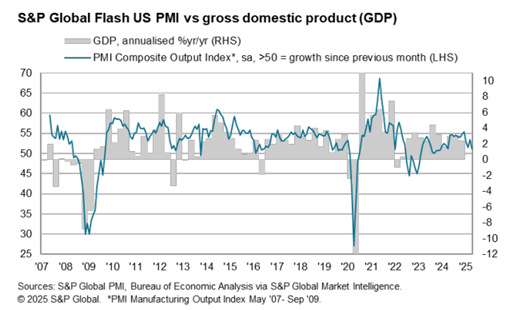

US economic activity continues to slow in April, according to PMI survey data. Output rose last month at its slowest pace since Dec 2023 via the US Composite Output Index, a GDP proxy. “The early flash PMI data for April point to a marked slowing of business activity growth at the start of the second quarter, accompanied by a slump in optimism about the outlook,” said Chris Williamson, chief business economist at S&P Global Market Intelligence, which published the report. “At the same time, price pressures intensified, creating a headache for a central bank which is coming under increasing pressure to shore up a weakening economy just as inflation looks set to rise.”

Businesses are looking for ways to pass increasing costs due to tariffs onto customers, according to the Federal Reserve’s Beige Book. “Most businesses expected to pass through additional costs to customers. However, there were reports about margin compression amid increased costs, as demand remained tepid in some sectors, especially for consumer-facing firms.”

New US home sales rose in March, supported by a modest decline in mortgage rates and lean existing inventory. Sales of newly built, single-family homes increased 7.4% vs. the year-ago level.

President Trump continues to press Fed Chairman Powell on rate cuts. “I might call him. I haven’t called him, but I believe he’s making a mistake by not lowering interest rates,” Trump said in Oval Office remarks to reporters on Wednesday.

Inflation expectations among businessess increased by 0.3 percentage points to 2.8%, on average, in April, according to the Atlanta Fed’s monthly poll. The expected inflation rate has increased every month so far in 2025 and is now at the highest level since July 2023.

Author: James Picerno