Macro Briefing: 6 May 2025

The US services sector posted a stronger growth rate in April, according to the survey-based ISM Services PMI…The Federal Reserve is in a “lose-lose scenario” with monetary policy because of the “haphazard rollout of President Trump’s tariff policy,” according to The Wall Street Journ…

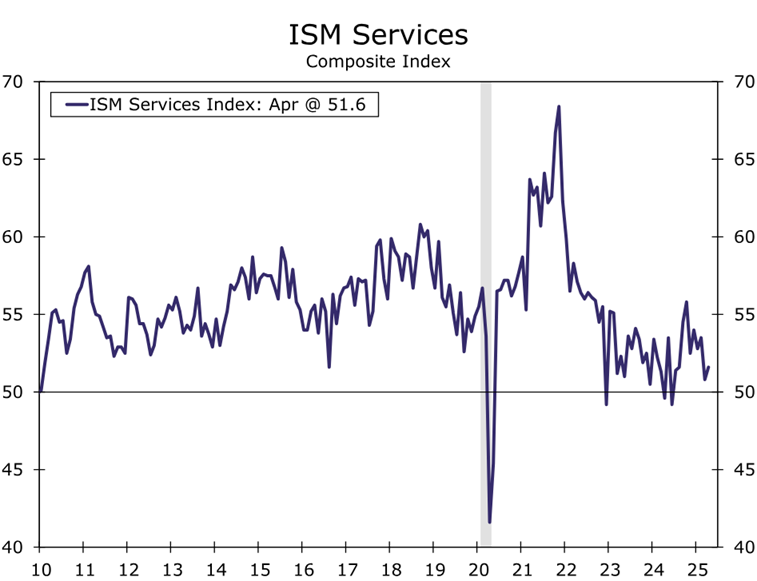

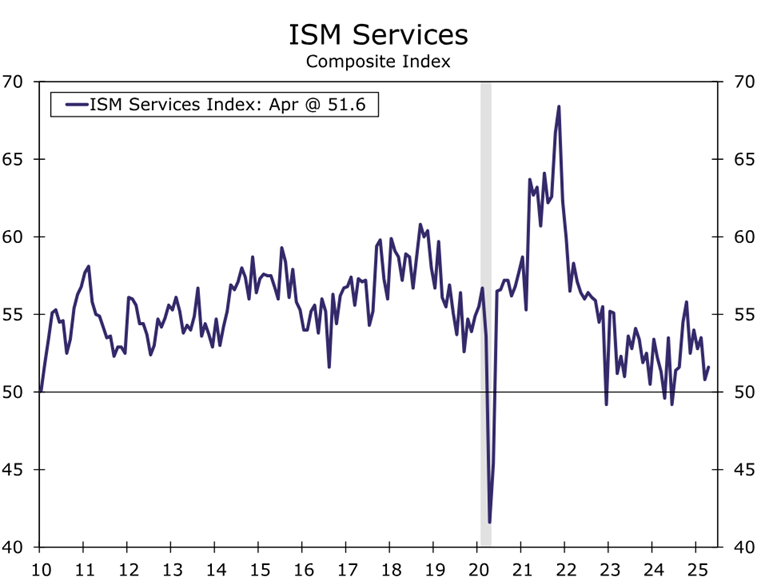

The US services sector posted a stronger growth rate in April, according to the survey-based ISM Services PMI. The indicator edged up to 51.6, reflecting a modest pace of growth by printing above the neutral 50 mark. But in a worrisome sign for the inflation outlook, the prices paid component of the survey rose to a 27-month high.

The Federal Reserve is in a “lose-lose scenario” with monetary policy because of the “haphazard rollout of President Trump’s tariff policy,” according to The Wall Street Journal. The central bank’s dilemma is that it faces a potential for managing policy when economists see a higher risk of either a recession or stagflation. “This is not going to be a cycle where the Fed pre-emptively cuts because there’s a forecast of a slowdown. They’re going to actually need to see it in the tangible data, in particular the labor market,” said Richard Clarida, a former Fed official now at the bond manager Pimco.

White House asks American firms and consumers to be patient amid elevated anxiety over tariffs and expectations for rising prices. The request for tolerance comes ahead of forecasts of “A slump in arrivals at ports [that] represents the first clear sign of supply chain disruption that industry players say could ripple to consumers over the next several weeks, sparking shortages and pushing prices higher for everyday goods like cars, furniture, clothes and even basic children’s toys,” Politico reports.

The US stock market traded at 8% discount to fair value at the end of April, according to Morningstar: “Investors should look to market-weight stocks overall but overweight value and core. Sector valuations rise toward fair value from deeply undervalued levels, and energy is increasingly attractive.”

US economic growth slowed in April to its weakest pace since September 2023, according to the survey-based S&P Global US Composite PMI, a GDP proxy. “A rise in new work was also recorded, but to only a modest degree,” S&P Global reported. “Amid uncertainty over trade policies, business expectations slumped to their lowest level for two-and-a-half years, whilst employment numbers were little changed.”

Author: James Picerno