Macro Briefing: 20 May 2025

The US Leading Economic Index fell sharply in April, dropping for a fifth straight month, the Conference Board reported… “The US LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize,” said Justyna Z…

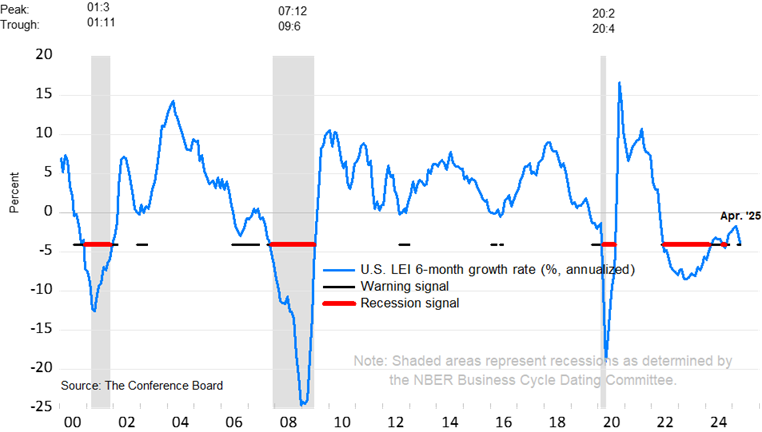

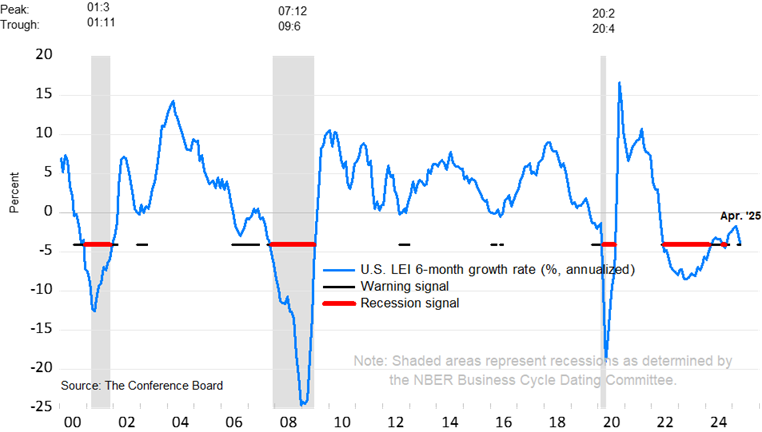

The US Leading Economic Index fell sharply in April, dropping for a fifth straight month, the Conference Board reported. “The US LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at the consultancy. The six-month growth rate for the index declined further in April, but remained slightly above the recession signal threshold.

House Republicans continue to battle over a variety of key issues that threaten to derail the GOP’s plan to pass its spending bill for the federal government. The legislation passed the House Budget Committee on Sunday, but the warring factions in the Republican party have yet to find enough common ground for pass the legislation with a full House vote.

China appears to be maintaining tight control over its rare earth exports despite a 90-day truce for the trade war with the US. Businesses are unsure if last week’s temporary trade agreement applies to China’s export controls on seven rare earth minerals and associated products, which are essential components to a range of products, ranging from iPhones to fighter jets and missile systems.

US Senate approved bill on stablecoins on a bipartisan vote. The GENIUS Act sets up a regulatory framework for stablecoins and digital tokens pegged to fiat currencies like the US dollar.

US 30-year Treasury yield briefly topped 5% on Monday after Moody’s downgrades US credit rating. “With tax cuts and tariffs hanging in the balance, Moody’s appears to be sending a message that it thinks these policy changes will, on net, put the US on an even worse fiscal trajectory,” wrote Bank of America economist Aditya Bhave in a note. “That is, tariff revenues won’t fully offset the cost of the proposed tax bill. We agree.”

Author: James Picerno