Macro Briefing: 3 June 2025

“The fact that capital is rotating back into US large cap Tech/Big Tech is further proof that the market has finally found its footing,” DataTrek Research co-founder Nicholas Colas wrote in a note to clients…US manufacturing contracted for a third straight month in May, based on survey data…..

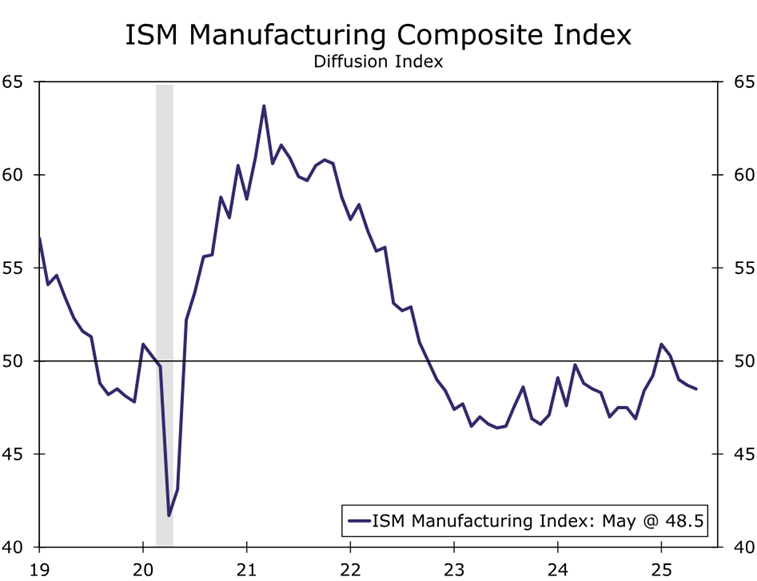

US manufacturing contracted for a third straight month in May, based on survey data. The ISM Manufacturing Index edged lower last month to a six-month low of 48.5, moderately below the neutral 50 mark that separates growth from contraction. “The outlook for the manufacturing sector looks downbeat, particularly with the initial surge in demand from front-loading now behind us,” said Matthew Martin, senior economist at Oxford Economics. “Businesses are contending with higher input costs, supply disruptions, and domestic and foreign customers wary of committing to new orders.”

OECD cut its growth outlook for US and global economy. The organization reduced its US growth forecast down to a modest 1.6% this year and 1.5% for 2026. “Global GDP growth is projected to slow from 3.3% in 2024 to 2.9% this year and in 2026 … on the technical assumption that tariff rates as of mid-May are sustained despite ongoing legal challenges,” the OECD said.

US construction spending unexpectedly fell in April. The Commerce Department said construction spending fell by 0.4% — economists were predicting a 0.3% rise.

China manufacturing conditions deteriorated in May for the first time in eight months, according to the survey-based Caixin China General Manufacturing PMI. “Both supply and demand declined as market conditions worsened. Manufacturing output recorded its first contraction in 19 months, falling at the fastest pace since November 2022. Total new orders declined for the first time in eight months, at the sharpest pace since September 2022,” said Dr. Wang Zhe.

Senior Economist at Caixin Insight Group.

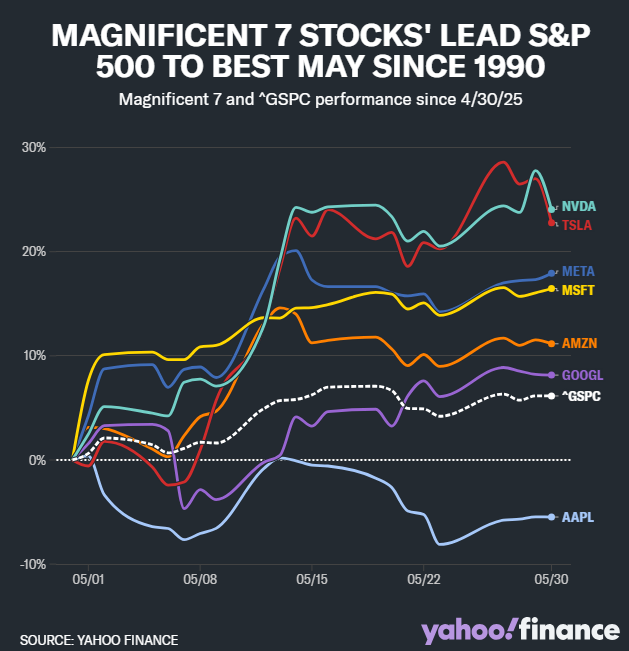

Big tech stocks led the US equity market in May, suggesting the “Magnificent 7” shares “has genuine momentum,” advised an analyst. “The fact that capital is rotating back into US large cap Tech/Big Tech is further proof that the market has finally found its footing,” DataTrek Research co-founder Nicholas Colas wrote in a note to clients.

Author: James Picerno