Momentum Is Still Crushing It This Year For US Equity Factors

The deepest setbacks are in small-cap equities, which continue to struggle… The biggest loss this year is in small-cap value (IJS), which has shed more than 10%…The long-running drought in small caps shows no sign of ending, although some analysts see a window of opportunity… small-cap] e…

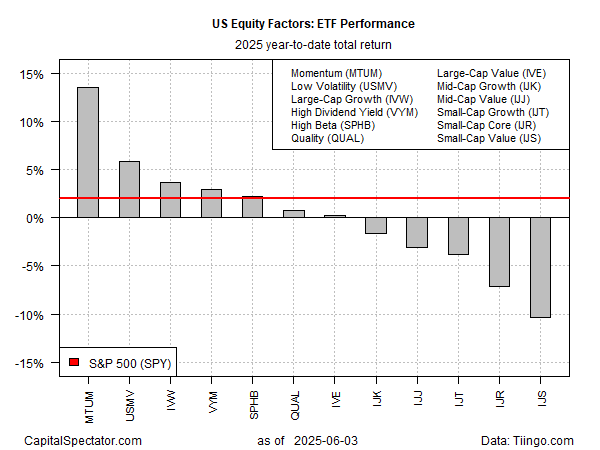

The US stock market has recovered most of its recent losses, and the rebound has left momentum strategies far ahead in the performance horse race for equity factor results this year, based on a set of ETFs through yesterday’s close (June 3).

The iShares MSCI USA Momentum Factor ETF (MTUM) is up a sizzling 13.5% year to date. That’s a hefty return premium over the broad equity market, which is up just 2.0%, based on the SPDR S&P 500 (SPY).

Factor performance overall is mixed this year, with about half of the strategies still nursing losses in 2025. The deepest setbacks are in small-cap equities, which continue to struggle. The biggest loss this year is in small-cap value (IJS), which has shed more than 10%.

The long-running drought in small caps shows no sign of ending, although some analysts see a window of opportunity. John Higgins, chief markets economist at Capital Economics, writes:

“[U.S. small-cap] equities could conceivably be in for an easier time if worries about the US economy ease. That is something we envisage, despite potential flashpoints in the trade war in the coming months. It may not be enough, however, to trigger a lasting turnaround in their relative performance.”

The technical profile for small caps still looks negative and so the near-term prospects for these stocks remains challenging. Par for the course: The Capital Spectator has been observing for several years that this slice of the equity factor universe has routinely disappointed.

In early 2024, for example, there was speculation that small caps were poised for a “comeback,” to cite one analyst’s view at the time. That turned out to be another false dawn. More of the same is likely until the technical picture for small caps revives. At the moment, such a turnaround (still) doesn’t appear imminent.

Author: James Picerno