Macro Briefing: 5 June 2025

“After a strong start to the year, hiring is losing momentum,” said Nela Richardson, chief economist for ADP…US services sector unexpectedly contracted slightly in May, according to survey data via ISM Services Index… Another survey of the services sector paints a brighter profile: the S&am…

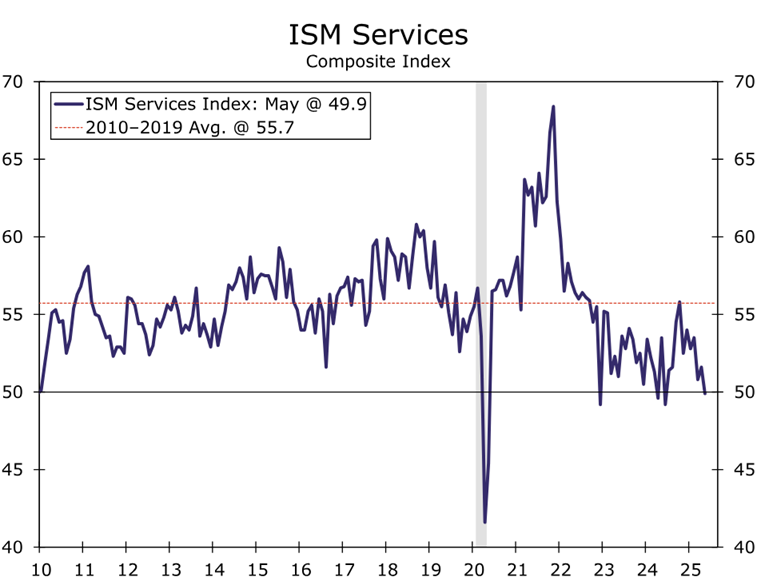

US services sector unexpectedly contracted slightly in May, according to survey data via ISM Services Index. The index dropped to 49.4 last month, just below the neutral 50 mark, easing to the lowest level since June 2024. Another survey of the services sector paints a brighter profile: the S&P Global US Services PMI posted a firmer pace of moderate growth last month. “That said, the improvements come from a low base, following a very gloomy April, which saw growth nearly stall as confidence sank to a two-and-half year low,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

Hiring by US companies slowed to a crawl in May, according to the ADP Employment Report. Payrolls rose just 37,000 last month, far below expectations and the lowest increase since March 2023. “After a strong start to the year, hiring is losing momentum,” said Nela Richardson, chief economist for ADP.

The US economy has contracted over the past six weeks as hiring has slowed and consumers and businesses become more cautious due to tariff-related price increases, according to the Fed’s Beige Book report. “All Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions,” the report noted.

Auto industry groups are highlight risks related to shortage of rare earths materials. “With a deeply intertwined global supply chain, China’s export restrictions are already shutting down production in Europe’s supplier sector,” said Benjamin Krieger, secretary general of Europe’s auto supplier association CLEPA.

Big institutional investors are shifting away from US markets, reports the Financial Times. “People need to rethink” their exposure to the US, said Seth Bernstein, chief executive of AllianceBernstein, which manages $780bn in assets. “The deficit has been out there as an issue; it’s just getting worse,” he added. “I think it is untenable for the United States to continue borrowing at the pace it’s borrowing . . . When you couple that with what’s going on with the unpredictability of our trade policy… It should cause people to pause and consider: how much do you want concentrated in one market?” Meanwhile, an index fund track global stocks ex-US (VXUS) rose to a record high in yesterday’s trading.

Author: James Picerno