Macro Briefing: 11 June 2025

” The Federal Reserve is expected to keep interest rates steady at least another couple of months, according to most economists polled by Reuters…The World Bank downgrades the outlook for US and global growth, citing tariffs…3% growth forecast for 2025 that the bank published in January… The…

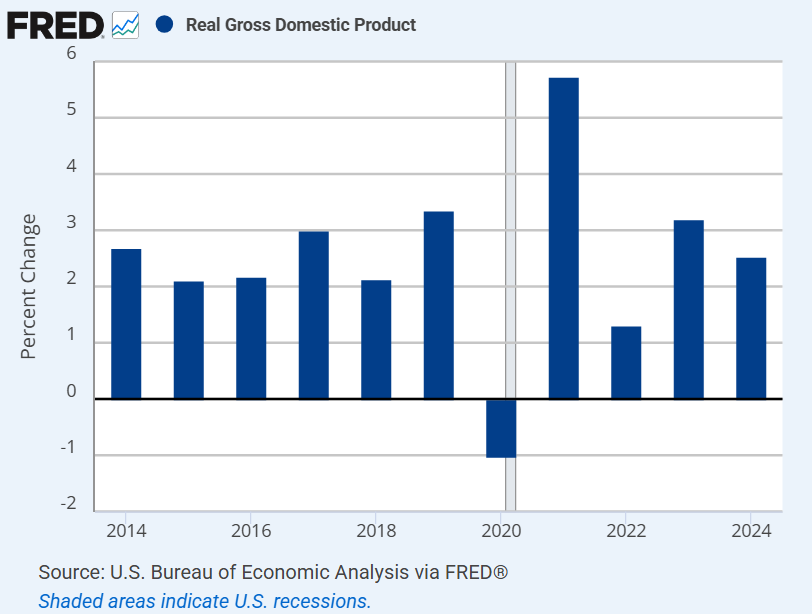

The World Bank downgrades the outlook for US and global growth, citing tariffs. Due to “a substantial rise in trade barriers,” the US economy would grow half as fast (1.4%) vs. 2024 (2.8%). The new forecast reflects a downgrade from the 2.3% growth forecast for 2025 that the bank published in January. The forecast also projects the slowest decade for global growth since the 1960s.

US and China reach agreement in trade talks on “a framework to implement the Geneva consensus and the call between the two presidents,” US Commerce Secretary Howard Lutnick told reporters. Reports that both sides will brief their leaders “is a clear sign that some disagreements or unresolved details still require internal discussion,” said Jianwei Xu, senior economist at Natixis.

US appeals court leaves tariffs intact. Axios reports: “The ruling preserves, for now, Trump’s sweeping efforts to reorder international trade, but will also prolong the uncertainty over their impact.”

The GOP megabill under discussion in the Senate could undermine US energy production, Republicans warn. The House-passed bill is not “fair to businesses in the way that we’re phasing [the credits] out,” said Utah Republican Sen. John Curtis. “Investors have invested billions of dollars based on the rules of the road, and you have employees who have set careers based on these things.”

The US crackdown on immigration crackdown appears to be slowing employment growth in industries that rely on unauthorized workers has slowed. The Wall Street Journal reports: “There has been a large decline in the foreign-born labor force since March. And recent immigrants appear more reluctant to take part in the Labor Department’s monthly survey of households.”

The Federal Reserve is expected to keep interest rates steady at least another couple of months, according to most economists polled by Reuters. “As long as the labor market looks fine, we expect the FOMC to continue to stay on hold, and use rhetoric to bolster their inflation-fighting credibility. Until there is a cost, why signal otherwise?” said Jonathan Pingle, chief US economist at UBS.

Author: James Picerno