Macro Briefing: 18 June 2025

US retail sales fell the most in four months in May, dropping more than expected… US homebuilder sentiment fell again in June, marking the third-lowest reading since 2012, based on the Housing Market Index… Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff…

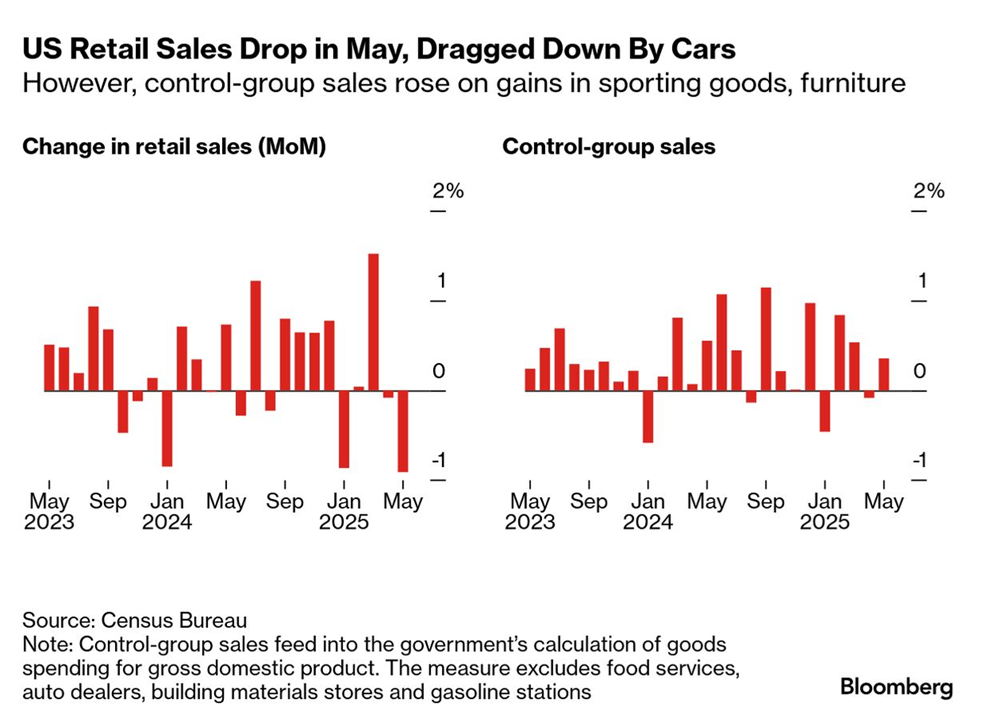

US retail sales fell the most in four months in May, dropping more than expected. “Tariff announcements have had a clear impact on the timing of large-ticket purchases, notably autos, but there are few signs yet that tariffs are leading to a general pullback in consumer spending,” said Michael Pearce, deputy chief economist at Oxford Economics. “We expect a more marked slowdown to take hold in the second half of the year, as tariffs begin to weigh on real disposable incomes.”

The US military is reportedly preparing to potentially join Israel’s attack on Iran. “I’ve been negotiating. I told them to do the deal,” Trump said on Tuesday. “They should have done the deal. The cities have been blown to pieces, lost a lot of people. They should have done the deal. I told them do the deal, so I don’t know. I’m not too much in the mood to negotiate.”

Markets today will focus on today’s Federal Reserve’s policy announcement, revised economic projections and press conference. No change in interest rates is expected from the central bank. The update of the so-called dot-plot, a quarterly chart that shows each Fed official’s prediction about the outlook for target rate, will be of interest. “This meeting will be all about the dot plot,” said former Kansas City Fed president Esther George. She predicts that “they will be reluctant to signal changes from where they were earlier.”

US industrial production eased in May, posting a decline that surprised economists. The manufacturing component of the report, by contrast, ticked up 0.1% in May, matching the consensus and rebounding from the 0.5% decrease in the prior month.

Import prices for goods coming into the US were flat in May, partly due to a decline in energy costs, the Labor Dept reported. The zero-percent change last month follows a 0.1% increase in April.

US homebuilder sentiment fell again in June, marking the third-lowest reading since 2012, based on the Housing Market Index. Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, N.C. “To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices.”

Author: James Picerno