Macro Briefing: 24 June 2025

0 in May, above the neutral 50 mark that separates growth from contraction… A second Fed official says a cut in interest rates should be on the table for the upcoming policy meeting in July…” On Friday, Fed Governor Chris Waller said the central bank should cut rates as early as the next FOMC …

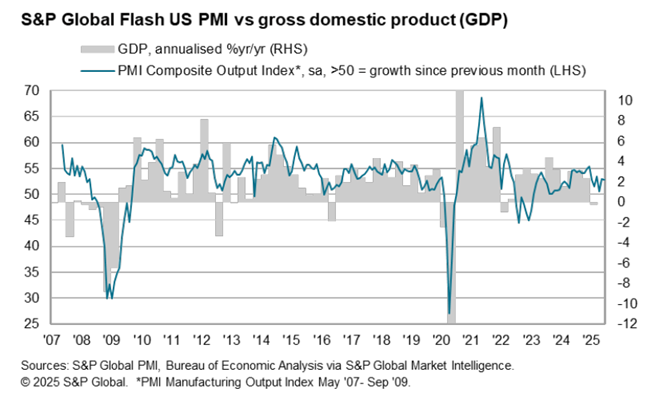

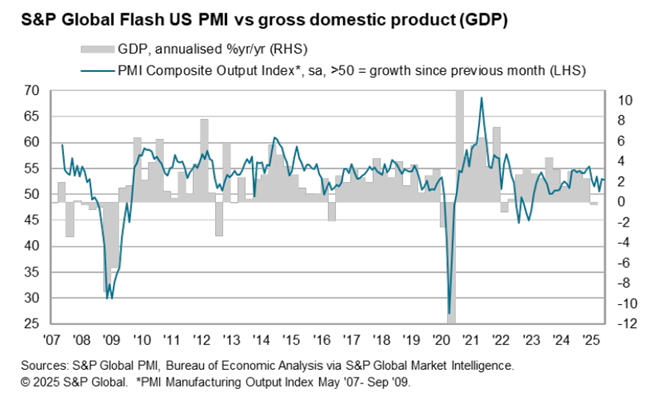

US business activity slowed in June but continues to post modest growth, according to a survey-based estimate of GDP. The S&P Global Flash US PMI ticked down last month to 52.8 from 53.0 in May, above the neutral 50 mark that separates growth from contraction. “The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months,” said the chief business economist at S&P Global Market Intelligence.

Israel accused Iran of violating a fragile ceasefire that President Trump announced on social media. “THE CEASEFIRE IS NOW IN EFFECT. PLEASE DO NOT VIOLATE IT!” Trump said in a post.

A second Fed official says a cut in interest rates should be on the table for the upcoming policy meeting in July. “It is likely that the impact of tariffs on inflation may take longer, be more delayed, and have a smaller effect than initially expected,” Bowman said in a speech Monday. “Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting.” On Friday, Fed Governor Chris Waller said the central bank should cut rates as early as the next FOMC meeting on July. Fed funds futures this morning are pricing in a low probability (23%) for a cut at the July 30 meeting.

Roughly 400,000 manufacturing jobs are currently unfilled in the US, according to the Bureau of Labor Statistics. The shortfall in unemployment is expected to increase if companies are forced to rely less on manufacturing overseas and build more factories in the US, experts predict.

US existing home sales fell 0.7% in May vs. the year-earlier level. The monthly 0.8% marks the slowest May for existing home sales since 2009.

Markets continue to downplay the risks of the Israel-Iran conflict. “The markets are muted again for two reasons. Number one is there are elements of the market getting jaded at Trump policy changes, though this has been going on for a while,” said Hugh Dive, chief investment officer at Atlas Funds Management. Another is the subdued Iranian response so far to US strikes on its nuclear facilities. A missile strike by Iran on a US airbase in Qatar was telegraphed in advance and resulted in no casualties.

The price of crude oil (a proxy for risk sentiment re: the Israel-Iran conflict) has fell sharply on Monday. So far, Iran’s retaliation to strikes from Israel and the US have yet to target the flow of oil. There has been concern that Iran would attempt to stop the flow of oil through the Persian Gulf and drive up energy prices, which could trigger an economic shock for the global economy. So far, however, that fear has been unfounded and the recent spike in oil prices has reversed.

Author: James Picerno